Bitcoin Reversal Grows Ahead of FOMC Minutes

BTC Slide Deepens

Bitcoin prices remain under pressure through the middle of the week with the futures market breaking down to fresh lows for the month earlier today. The move comes on the back of a 3% slide yesterday with BTC now down almost 10% from the all-time highs printed last week. Given the expectation that the Fed will push ahead with fresh easing next month, and with institutional adoption in the US poised to soar following Trump’s 401k inclusion order, the move seems likely linked to profit taking rather than a shift in sentiment. Bitcoin often sees volatility when attempting to breakout to new highs and for now the current move looks purely corrective, with the bull outlook still intact.

FOMC & Jackson Hole

The sell off from highs has seen BTC shedding around $400 billion in market cap from the roughly $2.5 trillion peak. Given the rally we saw prior to this correction lower, the move has been attributed to profit taking ahead of the FOMC minutes later today and the Fed’s Jackson Hole symposium on Friday. If the minutes tonight are seen leaning on the dovish side with policymakers voicing support for easing, we could quickly see BTC move back up towards highs. On Friday, traders will then be looking for a firm signal from Powell that the Fed is likely to cut rates next month. Again, if delivered, this will be firmly bullish for risk markets, sending BTC higher as USD weakens. However, if the minutes take a more neutral tone today with policymakers seen dwelling on inflation risks, and if Powell refrains from giving an easing signal on Friday, BTC could push much deeper near-term as risk assets soften further.

Technical Views

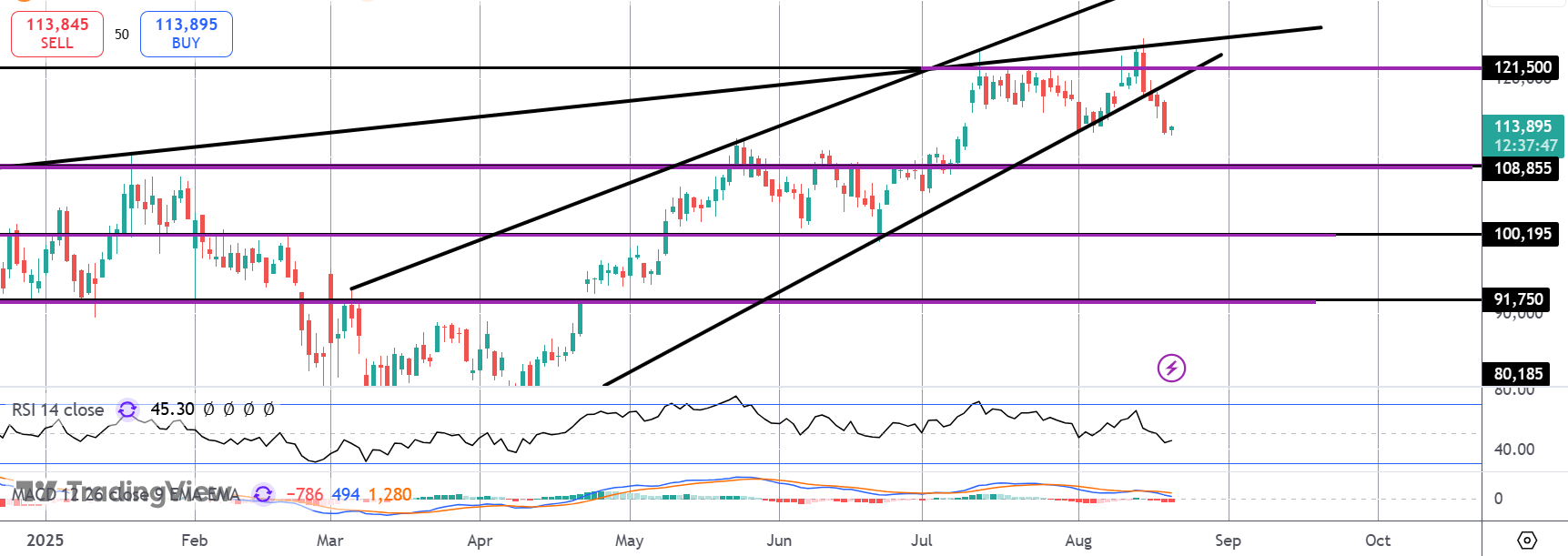

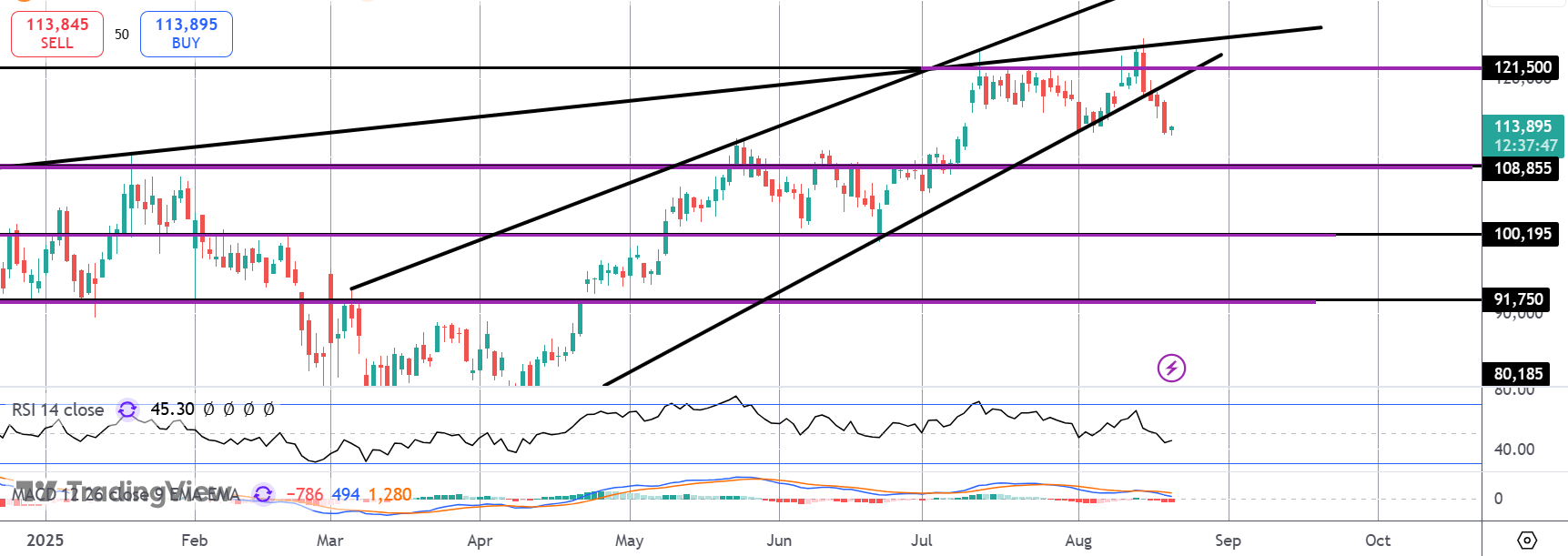

BTC

The rally in BTC has stalled for now into a test of the $121,500 level and rising wedge resistance. The market has since reversed and broken down out of the wedge with focus now on a test of next support at $108,855. Bulls need to defend this level to maintain the broader bull view and prevent a deeper drop back to the $100k mark.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.