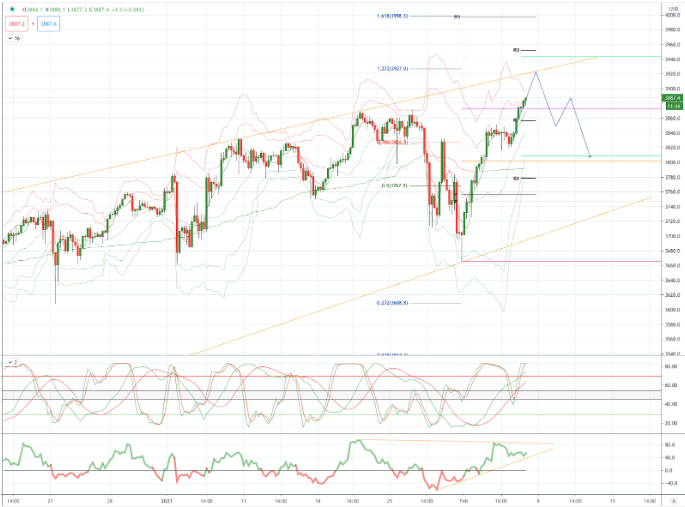

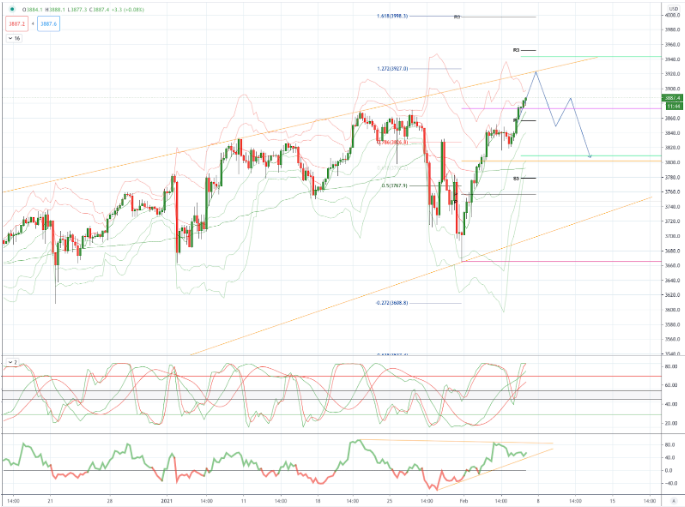

Chart of The Day S&P500

Chart of The Day S&P500

S&P500 Probable Price Path & Potential Reversal Zone

Global risk sentiment was lifted by economic optimism following a better than expected US initial jobless claims data which fell to its lowest since end-November. The Bank of England also voted 9-0 to keep its policy rate unchanged at 0.1% and its asset purchase program at GBP895bn, saying it would maintain the current case until 17 March. The S&P 500 closed up for a fourth session by 1.09% led by banks and tech shares (including EBay and PayPal, whereas GameStop tumbled 42% again), while VIX eased to 21.77. UST bonds bear-steepened further on a more upbeat BOE that said implementation of negative rate is not warranted for now, with the 5-30 year spread approaching 148bps (back to 2015 levels) as the 30-year yield came within sniffing distance of 1.95% and 10-year breakevens touched 2.19% (highest since May 2018). Meanwhile, the 3- month LIBOR dipped to 0.1926%.

The US labour market report will be a key focus for markets today. It is always seen as a key bellwether of US economic conditions, and today’s update for January follows a decline in employment in December. That was the first monthly fall since last April. It seemed to be primarily concentrated in sectors most impacted by social distancing restrictions as Covid-19 accelerated ahead of Christmas. Expect a modest rebound in employment in January and look for a 80k rise. The already released ADP report points to this, as it recorded a 174k increase following a 78k drop in December. Less positively also look for a small increase in the unemployment rate to 6.8% from 6.7%. Overall the data would be further confirmation that the rebound in the US labour market has stalled for now. Today’s release will also contain annual revisions for 2020 but these seem unlikely to fundamentally change the bleak picture of a very big fall in employment.

US international trade for December is also out today. The already released advanced report showed a smaller goods trade deficit compared to November. That should help pull down the overall deficit. Canada’s labour market report for January will be watched for whether employment has fallen for the third month in a row. The European data calendar is very light, with nothing of note in the UK. In Italy, retail sales are expected to have picked up in December but the rebound looks to have been relatively modest given the almost 7% decline in November

From a technical perspective the S&P500 looks poised to test the projected ascending trendline resistance and 127% Fibonacci extension of the late January decline at 3927 watch for bearish reversal patterns to develop here. Given the interaction between and among asset classes currently we have a dynamic that has characterised many short to medium term tops, the Dollar is rallying, yields are relatively robust and there has been a significant rotation in risk exposure that is reflected by recent portfolio moves, out of the tech heavy Nasdaq into the more value and defensive DJIA stocks. As such bearish exposure should be warranted with a sharp rejection from the 3927/37 area targeting at a minimum a three wave correction back to test bids towards 3800.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!