Chart of The Day US500 (S&P500)

Chart of The Day US500 (S&P500)

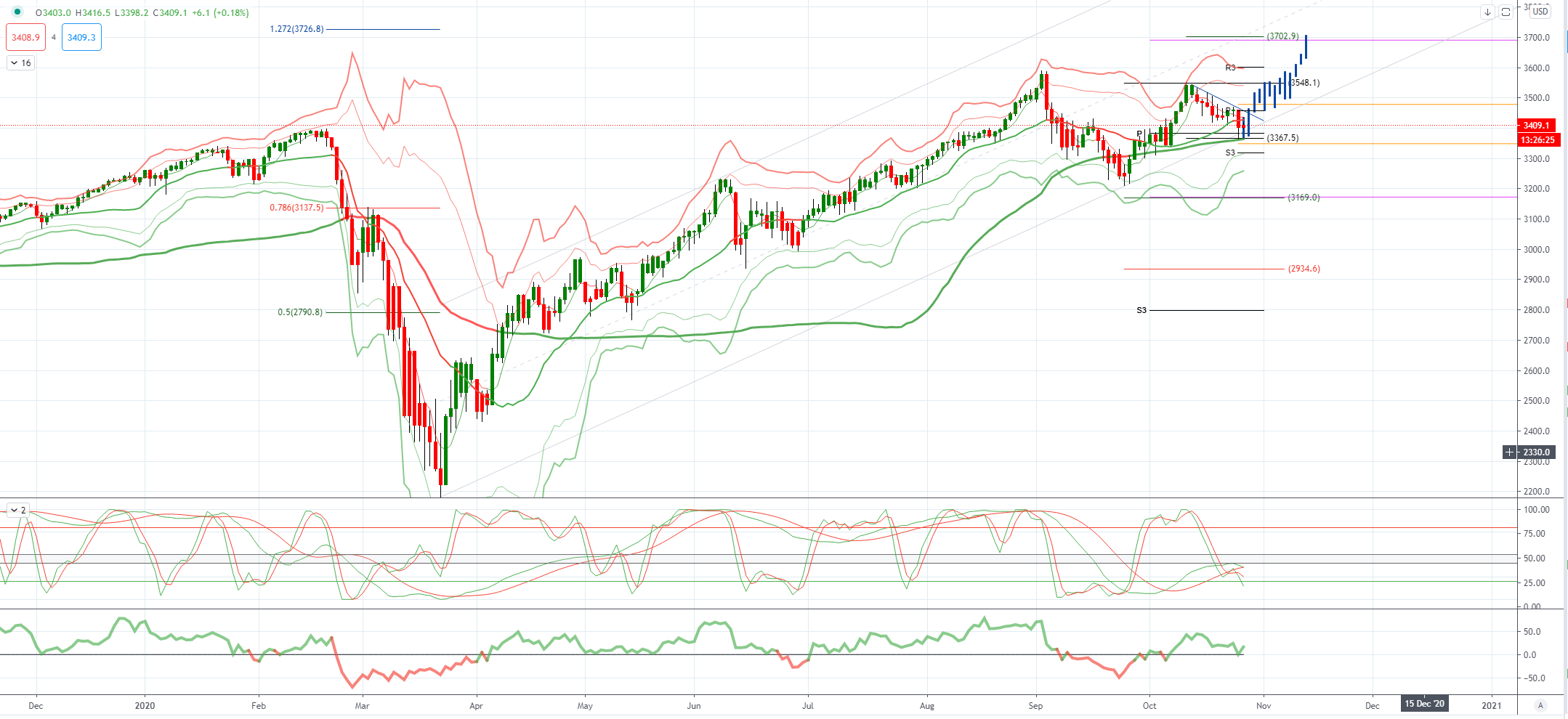

US500 (S&P500) Potential Reversal Zone & Probable Price Path

Risk off overnight as markets grappled with the fading prospects of a US fiscal stimulus before the 3rd November elections and rising US Covid cases hit a record for a second day, reigniting potential lockdown fears. The S&P 500 tumbled 1.86%, the most in a month, with VIX up to 32.46. USD rallied and UST bonds gained with the flight to safety, and the 10-year bond yield fell 4bps to 0.80% to flatten the yield curve. The 3- month LIBOR rose slightly to 0.2223%. Meanwhile, Ant Group is set to raise about $34.5bn from its record IPO. Separately, South Korea’s 3Q20 GDP grew 1.9% qoq up from -3.2% qoq in the previous quarter.

US New home sales declined 3.5% mom to a 959k annualized rate while the Dallas Fed manufacturing index came in at 19.8. BlackRock has downgraded UST debt on a blue-sweep outlook. Oil tumbled yesterday, with Brent falling 3.1% to $40.46/bbl. We have been mentioning that the lack of further confirmation from OPEC+ on the delay of additional supplies and the failure of Nancy Pelosi and Steven Mnuchin to iron out a US fiscal deal would lead oil prices lower. Support for Brent was seen at $40/bbl, but bearish pressures are strong at this time and may yet push the benchmark below this critical level.

From a technical and trading perspective, the S&P500 is testing pivotal support at 3365, this level represents projected ascending trendline support along with the monthly pivot point, this area attracted bids into the New York close of cash trading last night. Overnight we haven't seen any significant follow through on the downside. If bulls can muster a move back through yesterday's highs and the weekly pivot point at 3460, bullish exposure should be rewarded, initially targeting a test of 3548, then onto prior cycle highs at 2600 enroute to an equality objective and projected monthly range resistance sited at 3700. On the day a failure back through 3360 would concern the bullish thesis opening a test of bids back towards 3300

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 75% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!