Copper Softens on China Inflation Decline

Weak China Data

Following a promising rebound off the 4.300 level over the last week, copper prices are cooling a little here with the futures market slipping back below the 4.5785 level on Wednesday. The weakness comes on the back of softer-than-forecast China data overnight. Chinese CPI was seen cooling to 0.2% last month, down from 0.3% prior and below the 0.4% the market was looking for. This is the latest in a string of weak Chinese data, adding to the growing view that the world’s second largest economy is battling headwinds.

Fed Expectations

Away from China, copper prices have been buoyed over the last week as a result of shifting Fed expectations. On the back of recent US data weakness, traders have started scaling back up their Fed easing expectations for September. On the back of last week’s jobs numbers (higher NFP, downward revisions to priors, higher unemployment, lower wage growth), Fed’s Powell spoke yesterday of evidence of a cooling jobs market, further feeding easing expectations.

US Inflation on Watch

Looking ahead, the big focus now will be on tomorrow’s US CPI reading which will be crucial in determining USD direction ahead of the July FOMC. If we see a weaker reading, this should lead USD lower near-term, creating room for a fresh rally in copper. However, any upside surprise will be firmly bearish for copper, diluting near-term easing expectations and sending USD higher.

Technical Views

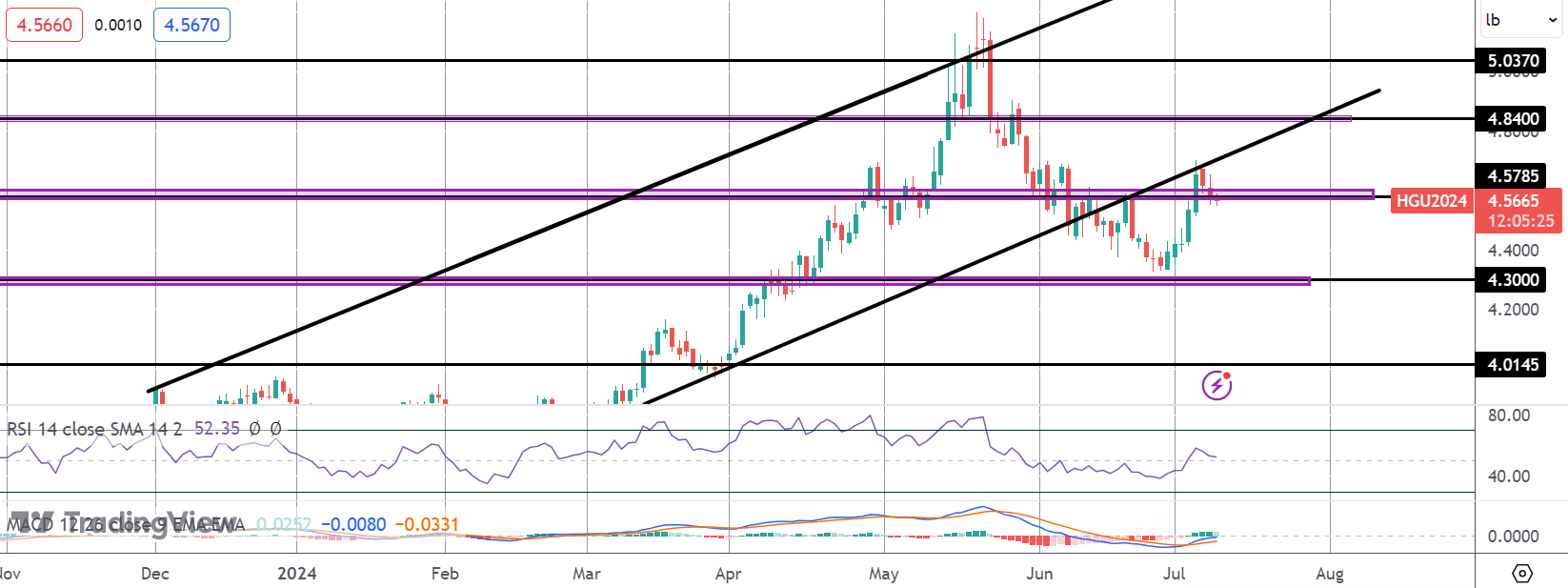

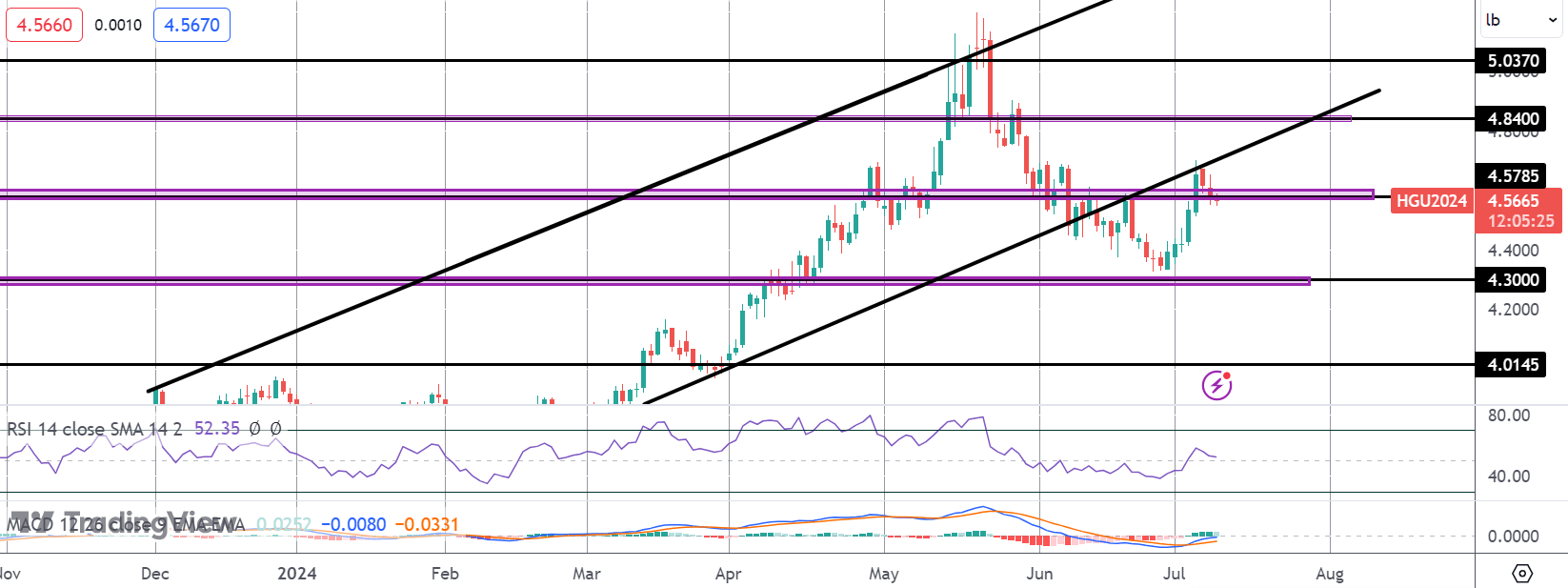

Copper

The rally in copper has stalled for now into a retest of the underside of the broken bull channel, with price now slipping back below the 4.5785 level. Below here, risks of a fresh move lower are seen with 4.3000 the key support to watch. If broken, focus turns to 4.0145 next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.