Daily Market Outlook, September 5, 2022

Daily Market Outlook, September 5, 2022

Overnight Headlines

- Gas Cut Pushes Euro To New Lows, Pound Falls To Lowest Level Since 1985

- Britain's Truss Expected To Be Named Conservative Leader, New PM

- Biden Administration To Maintain China Tariffs While Review Continues

- Senators Return To Work For Final Legislative Push Before Midterms

- World Food Prices Extend Drop As Supply Uptick Offers Relief

- China’s Covid Spread Persists After Mega-City Lockdown

- China Caixin Services PMI Softens In August, But Sector Growth Still Strong

- Japan's Services Sector Shrinks For First Time In Five Months In August

- Oil Rallies With OPEC+ Decision, G-7 Cap Plan Dominating Trading

- Germany To Levy Windfall Tax On Energy Groups To Fund €65Bln Aid Package

- Germany To Make ‘Billions’ Off Energy Firm Levy, Scholz Says

- Germany Will Stick To Debt Brake In 2023 Despite New Relief Package

- OPEC+ Likely To Freeze Output At Monday Meeting – WSJ Sources

- Russia Signals Opposition To OPEC+ Oil-Production Cut

- Gazprom Reportedly To Increase Gas To EU Via Ukraine After Nord Stream Halt

- Liz Truss Could Freeze Bills To Avoid Energy ‘Armageddon’

- Amazon Closes, Abandons Plans For Dozens Of US Warehouses

The Day Ahead

- Investor risk aversion prevailed in Asia, with most equity indices trading lower. Wholesale gas prices in Europe are sharply higher this morning after Russia announced at the weekend that the Nord Stream 1 pipeline will be shut indefinitely. The euro and pound have fallen further against the US dollar. Oil prices are firmer ahead today’s decision on output by OPEC+. US markets are closed for Labor Day.

- The new leader of the Conservative Party, either Liz Truss or Rishi Sunak, is expected to be announced today at around 12:30BST. A new Prime Minister will be formally installed on Tuesday. There are hopes that details of further significant support measures for households and businesses facing rising energy costs will be provided soon after the new PM takes office. Polls point to Truss as favourite to become the next PM, and she announced action will be forthcoming, potentially within a week of taking office, as reports suggest she is considering plans to freeze household bills while providing separate support for businesses.

- The other domestic event sterling markets will be focused on this week is the Bank of England MPC members’ testimony to Parliament on Wednesday. Ahead of that, MPC member Catherine Mann speaks today on inflation and monetary policy.

- The final readings for the August services PMI in the UK and Eurozone will be released this morning. The flash estimate revealed UK services PMI staying in the growth zone but, at 52.5, the pace of expansion was the slowest for eighteen months. Eurozone services PMI, meanwhile, fell to 50.2, just above the growth/contraction level. Eurozone retail sales and the Sentix investor confidence survey are also due.

- In the early hours of Tuesday (UK time), the Reserve Bank of Australia is expected to raise interest rates again by 50bp to 2.35%. Other major central banks later this week – the Bank of Canada on Wednesday and the European Central Bank on Thursday – are also expected to announce higher interest rates.

CFTC Data

- Specs add to USD long; sell into EUR strength, buy into yen weakness

- USD net spec long up in Aug 24-30 IMM period, amid $IDX +0.21%

- EUR$ +0.45% in period, anchored by 1.00; specs -3,567 contracts now -47,676

- $JPY rose 1.5% in period, specs -2,724 contracts now -41,531

- GBP$ -1.53% in period, specs -1,204 contracts now short 29,170

- AUD and CAD see small buying amid USD gain of 1%; CAD only spec long vs USD

- BTC specs buy into 7.05% dip near trend lows sub-20k, long grows to +1,296

- Source - Reuters Data

FX Options Expiring 10am New York Cut

- EUR/USD: 0.9850 (645M), 0.9875 (340M), 0.9900 (1.8BLN), 0.9925 (352M), 0.9950 (610M), 0.9975-80 (446M), 1.0000-05 (1.94BLN), 1.0020-25 (1.44BLN), 1.0050 (1.01BLN)

- USD/JPY: 138.00 (1.34BLN), 138.25-30 (380M), 138.65 (323M), 139.00 (250M), 139.25 (200M), 139.50 (300M), 140.00 (560M), 140.50 (260M)

- EUR/JPY: 139.57 (953M)

- GBP/USD: 1.1475 (252M), 1.1600 (560M), 1.1750 (291M)

- EUR/GBP: 0.8550 (250M)

- AUD/USD: 0.6795-00 (786M)

- USD/CAD: 1.3150 (310M), 1.3200-10 (341M)

Technical & Trade Views

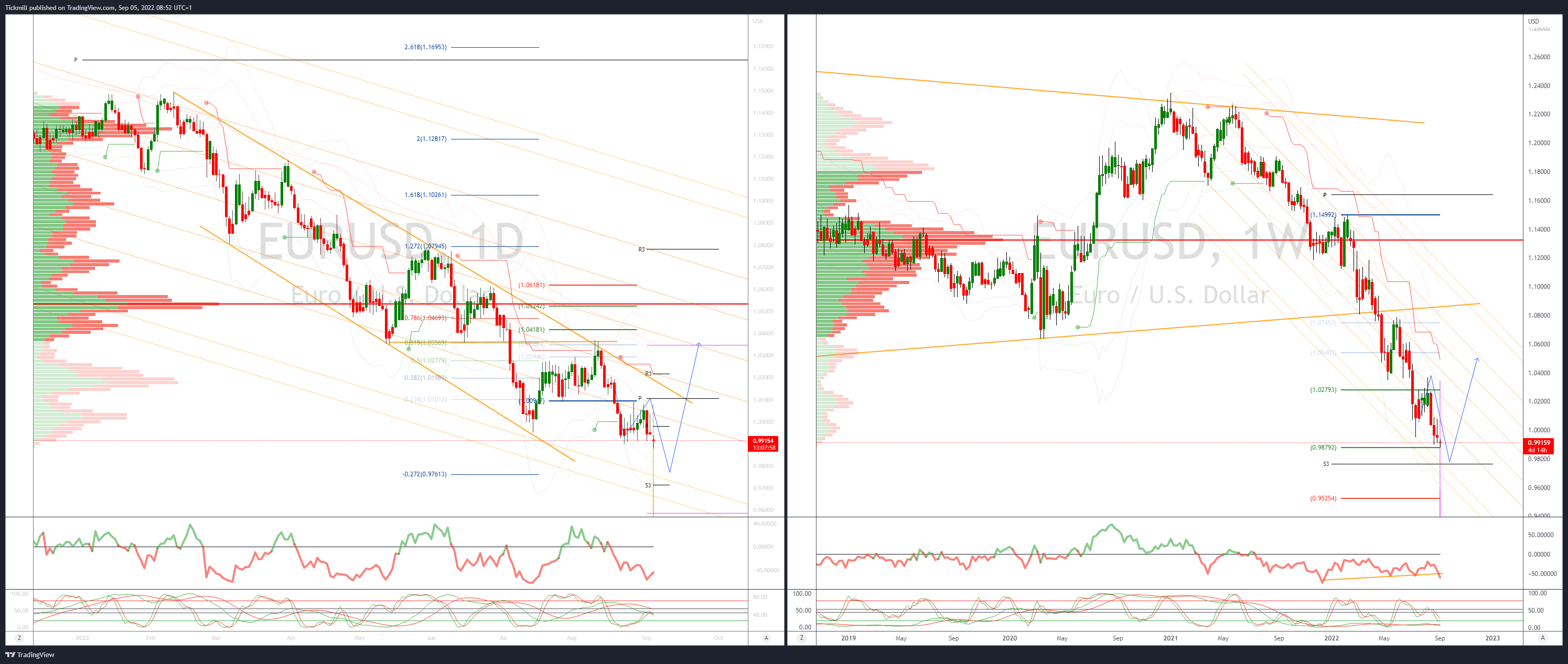

EURUSD Bias: Bearish below 1.0250

- Poised above key support – energy crunch approaches

- -0.45% - EU gas markets brace for price surge on Russia gas cut

- EU energy ministers discuss gas price cap, emergency liquidity

- Europe looks set to endure a tough winter as cost of living pressure surges

- 20 day VWAP bands track lower - bearish longer bearish trending setup

- Poised above well tested but vulnerable 0.9900 Aug-Sept range support

- Close above 1.0076 would delay further downside

- Sustained 0.9900 break would target 0.9608 base in September 2002

- 20 Day VWAP bearish, 5 Day bearish

GBPUSD Bias: Bearish below 1.2050

- Hit early – trends lower awaiting new Prime Minister

- -0.3%, Europe braces for a price surge on latest Russia gas cut

- UK PM favourite Truss promises immediate action on energy

- Will be interesting to see if Truss's policies change if she becomes PM

- Bearish trending setup targets 1.1413 March 2020 base longer-term

- Close above 1.1672 needed to undermine downside bias

- 1.1413 March 2020 low initial support, 1.1519 NY close resistance

- 20 Day VWAP is bearish, 5 Day bearish

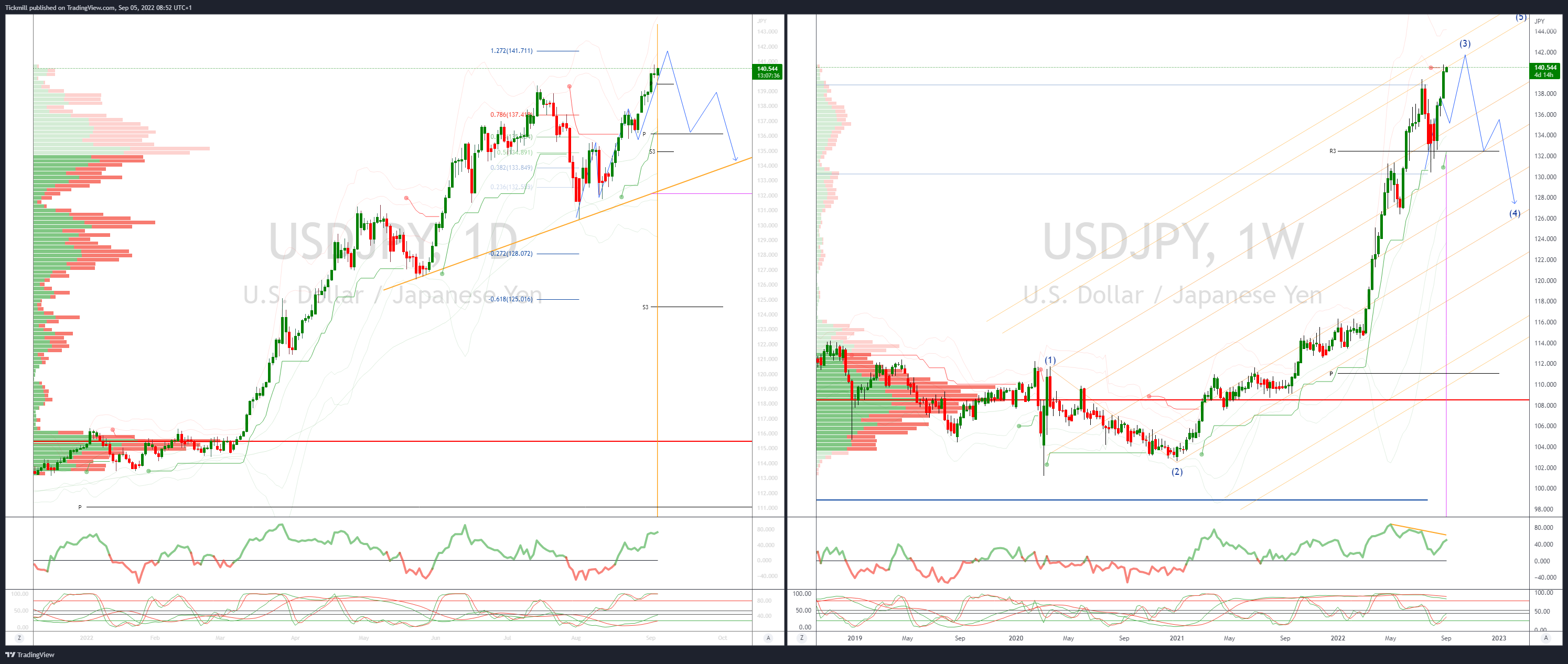

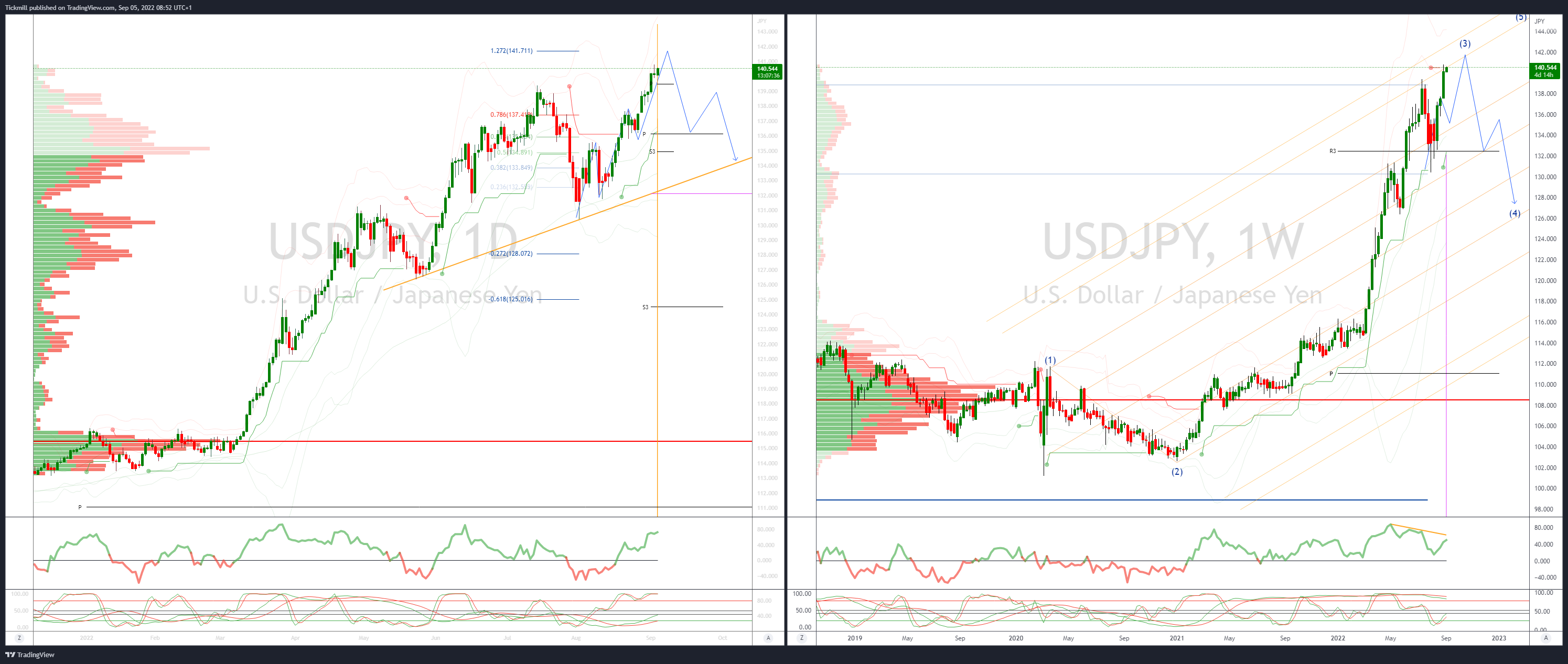

USDJPY Bias: Bullish above 133.40

- USD/JPY steady, JPY crosses mixed

- Relatively slow Asia session ahead of US Labour Day holiday

- USD/JPY 140.05-55 EBS, steady after push up to 140.80 Friday

- Retracement after good US jobs report Friday but downside limited

- 139.88 Friday low, low around time of jobs report release 139.90

- Bias up on hawkish Fed view despite push-back in US yields Friday

- Total $3.6 bln 140.00 strike option expiries this week

- Likely to exert some gravitational pull, could work as pivot

- Japanese importers still in dip-buy mode, especially sub-140.00 now

- Japanese exporter offers trail up, especially from ahead of 141.00

- 20 Day VWAP is bullish, 5 Day bullish

AUDUSD Bias: Bearish below .71

- Moves lower as USD gains on escalating EU energy crisis

- AUD/USD lower as energy crisis in Europe escalates ahead of winter

- EUR/USD fell over 0.50% to lead the USD broadly higher

- AUD/USD has traded as low as 0.6777 before bouncing to 0.6790/95

- Support is at the Sept 1 low at 0.6771 and break targets trend low at 0.6682

- Resistance is at 0.6868 and Friday's 0.6855 high

- 20 Day VWAP is bearish, 5 Day bearish

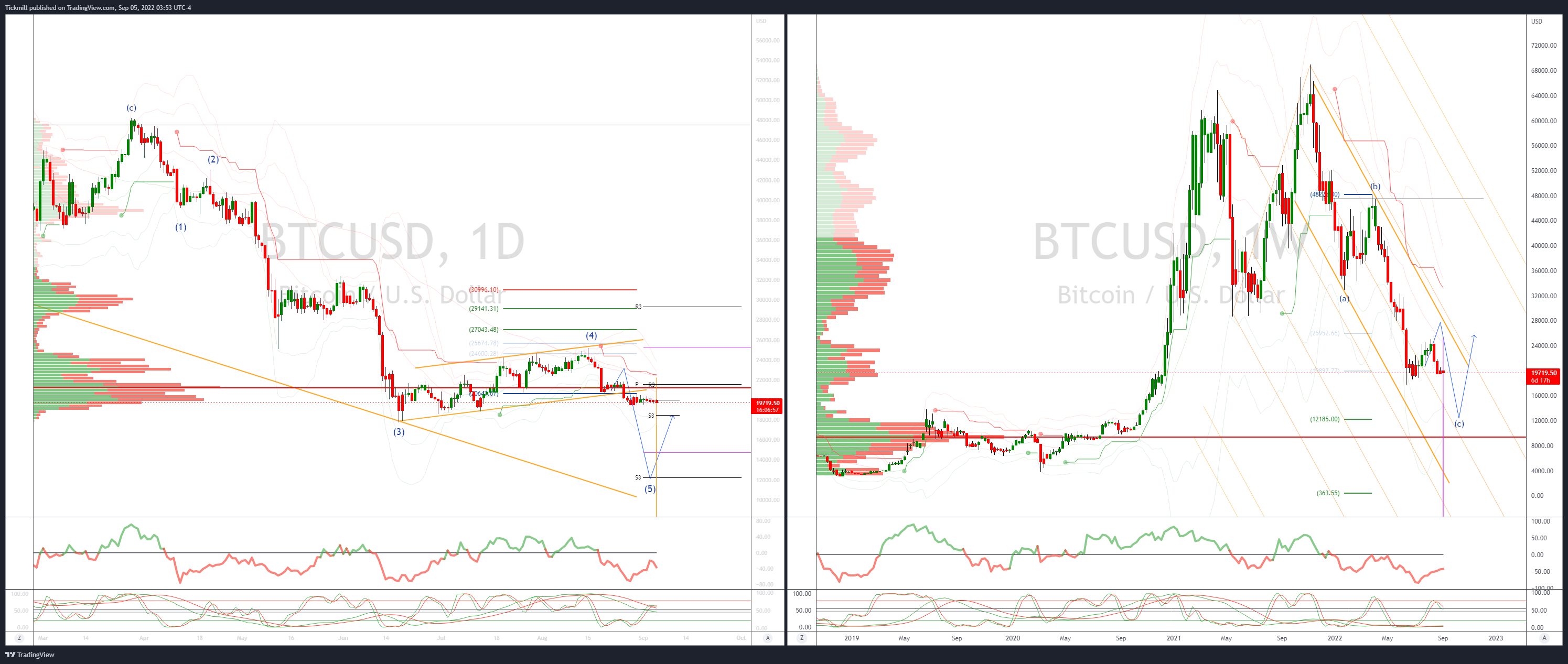

BTCUSD Bias: Bearish below 25.3K

- BTC trades sub 20k again

- Royal Crypto Bank Launches New Online Trading Website & Platform

- Crypto Oasis has teamed up with the Theatre of Digital Art (TODA) to launch arte Talks

- A first-of-its-kind bi-monthly initiative that will bring Web3 into the mainstream

- BTC supported by Jul 13 low 18.9k

- Aug 28's 22.2k may pull BTC higher

- 20 Day VWAP is bearish, 5 Day bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!