USD Higher Despite Mixed Data

The US Dollar continues to grind higher on Thursday with traders digesting a mixed set of US data yesterday, while awaiting the headline NFP release tomorrow. On the data front yesterday, firstly the ADP employment number was softer than forecast at 41k vs 49k expected but up sharply from the prior month’s -29k reading. We then saw the ISM services print coming in above forecasts at 54.4 vs 52.2 expected, up from 52.6 prior. Finally, the JOLTS job openings number came in weaker than forecasts at 7.15 million, below 7.61 million expected, down from 7.45 million prior. While the jobs data was on the soft side, the market reaction suggests that traders likely feel the underperformance wasn’t strong enough to bolster easing expectations at this point. Instead, focus will be firmly on tomorrow’s headline NFP release and its implications for upcoming Fed meetings.

NFP Expectations & Fed Implications

Looking ahead to tomorrow’s release, the market is looking for the headline NFP to print 66k up slightly from 64k prior with wages at 0.3% from 0.1% and the unemployment rate slightly lower at 4.5% from 4.6% prior. If these forecasts are satisfied, USD should remain supported near-term with little change to the rates outlook. Any upside surprise should see firmer demand near-term while it would likely take a sharp downside surprise to boost near-term easing expectations and fuel a USD sell-off. Current market pricing (as per the CME) shows a roughly 11% chance of a cut this month and a 40% chance of a cut in March. As such, there is plenty of room for a dovish repricing and downside USD volatility if the numbers do disappoint tomorrow.

Technical Views

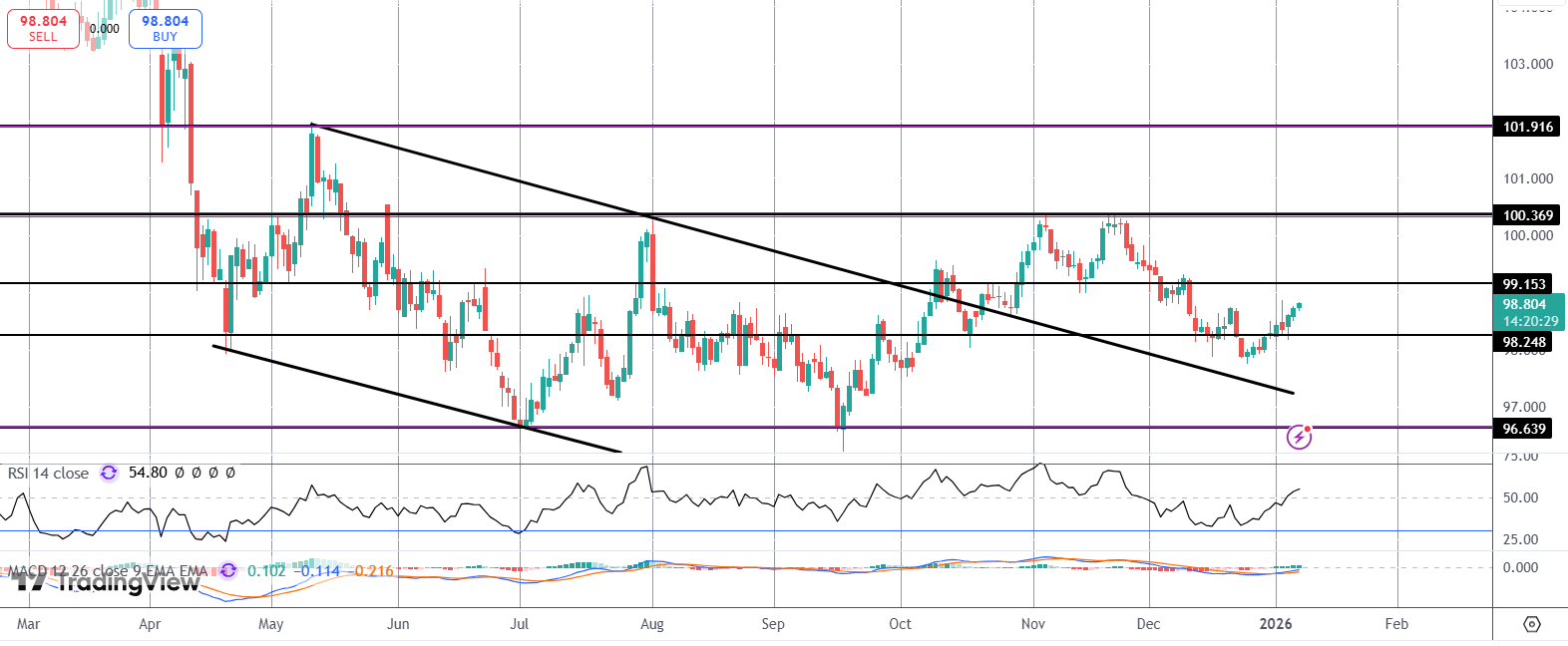

DXY

For now, DYX is trading back above the 98.24 level and with the bullish channel break still intact, focus is on a continuation higher. Near-term, 99.15 is the next res to watch with the late 2025 highs around the $100k mark the key focus above. If we do slip back below 98.24, 96.63 will be the key downside focus.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.