Dollar Volatility Risks Soar Ahead of US Elections

US Elections Next

Traders are bracing for heavy cross-market volatility this week with the US presidential elections tomorrow, the FOMC on Wednesday and the BOE on Thursday. The US Dollar is looking a little softer across early European trading on Monday. In recent sessions we’ve seen a greater degree of uncertainty creeping in with traders scaling back expectations of a Trump win. The return of the ‘Trump trade’ dynamic over October saw USD firmly higher while commodities and EMFX came under pressure. Now, just 24 hrs out from the election expectations look evenly split between the two candidates with many polls showing them neck-and-neck.

USD Risks

Given the rally we’ve seen in USD across recent weeks, there is room for a sharp short-squeeze in coming days if Harris wins. On the other hand, a Trump win could revive USD buying. However, this will largely depend on the composition of Congress. A Republican sweep would be firmly Dollar bullish and should reignite the ‘Trump trade.’ If Trump wins but the Democrats win Congress, however, USD upside will likely be more limited.

FOMC Outlook

Focus will then turn to the FOMC later in the week. The Fed is widely expected to cut by .25%. However, the bigger focus will be on the bank’s forward guidance and whether it gives a clear signal that further easing is likely this year. On the back of the heavily weaker-than-forecast US payrolls number last week, the view has turned more dovish again.

Technical Views

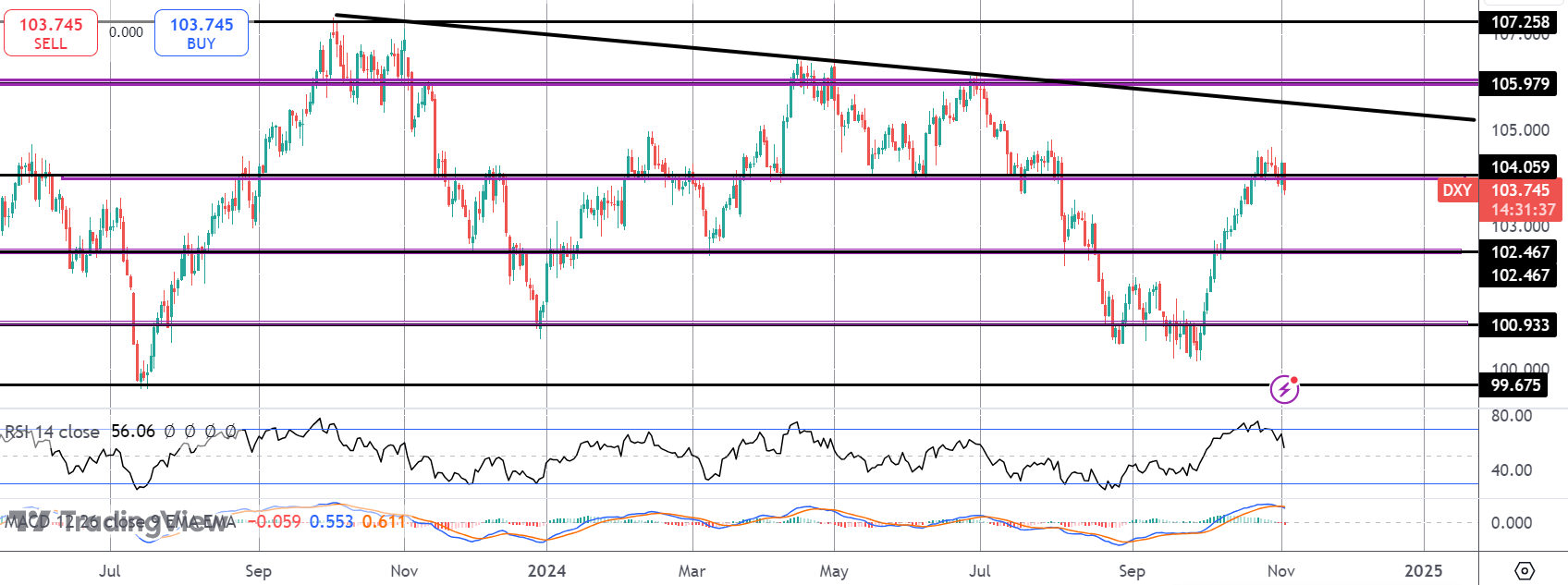

DXY

The rally in DXY has stalled for now into the 104.05 level with risks evenly split into the elections tomorrow. Topside, the bear trend line, 105.97 and 107.25 will be next resistance to watch. Below, 102.46 and 100.83 are the key supports to note.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.