Equities Surge on China's Trade Comments

Risk sentiment received a boost late in the week in response to a surprise announcement from China regarding the ongoing trade war between itself and the US. Gao Feng, a spokesman from the Chinese Ministry of Commerce told reporters “We firmly reject an escalation of the trade war, and are willing to negotiate and collaborate in order to solve this problem with a calm attitude.”

Feng went on to say, “China has plenty of means for counter measures, but under current situation, the question that should be discussed right now is about removing the U.S.′ new tariffs on $550 billion Chinese goods to prevent escalation of the trade war.”

China Appealing For Calm

Feng’s comments come just under a week since Trump threatened to raise tariffs on $250 billion in Chinese goods to 30% from 25% and increase tariffs on further $300 billion of goods to 15% from 10%, in response to Chinese retaliation. Trump also threatened to order US companies to cease operating in China, effectively severing all ties with the nation.

Trump’s Change in Tone on China

However, speaking during the closing of the G7 meetings on Monday, Trump said that there had been phone calls between negotiators from both countries and that he was confident a deal could now be done.

US and Chinese officials are due to meet for a further round of face-to-face trade talks in September. In light of these recent comments from both sides, the market is now hopeful that real progress can be made towards finally putting an end to the near two year long trade war which has ravaged global growth.

Central Banks Warn Against Trade War Impact

Leading central banks around the globe have warned against the damaging impact from the ongoing trade war as well as independent bodies such as the IMF. Indeed, a growing number of investment banks have been warning about the rising risk of a recession in the US as a consequence of the ongoing trade dispute.

Fed Under Pressure

The impact from the trade war has also impacted monetary policy in the US with the Fed having cut rates in July, citing downside risks from the trade war. Indeed, given the recent escalation in the trade dispute, the market is widely expecting further easing from the Fed. Trump himself has been particularly vocal in calling for the Fed to cut rates by as much as 1% in a bid to backstop the economy.

Markey Cautiously Optimistic

Despite optimism in response to the comments, the market remains cautious given the risk for talks to break down. On several occasions over recent months, surprise announcements and unexpected comments have rocked the markets and traders remain wary of the lingering risk of further such episodes.

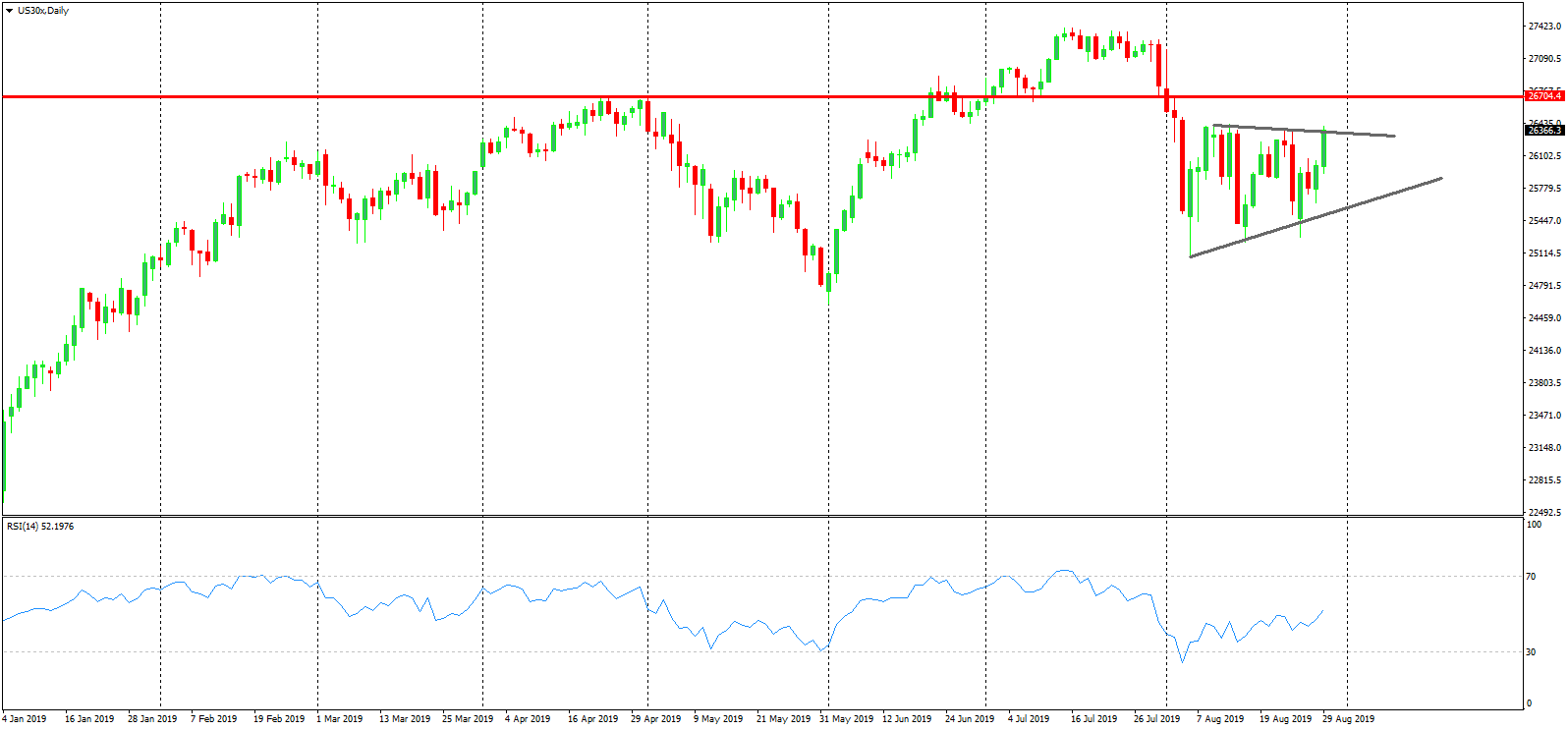

Technical Perspective

News of a more moderate tone from China has boosted US equities with the Dow rallying 200 points off the open yesterday in reaction. Price is now testing the upper trend line of the contracting triangle pattern which has formed following the break down from recent highs. The 26704.4 remains the key topside level to watch if we break higher from here. This could be the potential right shoulder of a large head and shoulders pattern and so bulls should be wary of any reversal candles in that region.

Please note that this material is provided for informational purposes only and should not be considered as investment advice. Trading in the financial markets is very risky.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.