EURUSD Targeting 1.0620... MS Month End Model Update

Technical & Trade View

EURUSD

Trade View

Bias: Bullish Above Bearish below 1.0390

Technicals

Primary support is 1.0390

Primary upside objective is 1.0620

Next pattern confirmation, acceptance above 1.0485

Failure below 1.03 opens a test of 1.0220

20 Day VWAP bullish, 5 Day VWAP bullish

Today’s New York Cut Option Expiries: 1.0240-50 (2.4BN), 1.0250 (2.0BN), 1.0300 (737M), 1.0350 (377M), 1.0390-00 (1.06BN), 1.0405-15 (777M), 1.0425 (1.0BN), 1.0450-55 (708M)

Institutional Insights

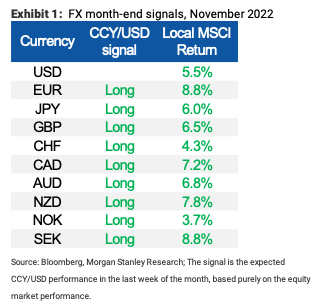

Analysts at Morgan Stanley note ‘Equity market performance appears to influence trading volumes and returns: We published a foundation report to show that local equity returns in G10 are linked to appreciating local currencies versus USD in the last week of the month, possibly due to asset manager flows (see Introducing Our FX Month-End Signal Framework). For November 2022 the model expects the US dollar to underperform: Our signal suggests that USD should weaken versus all currencies in the G10 this month-end. The FX month-end strategy considering the last week of the month has not performed as well over the past few months as it did earlier in the year. Last month, the dollar gained against most G10 currencies at month-end, though positive equity returns led to our signal suggesting dollar weakness.

.png)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!