How Far Will Bitcoin Correction Run?

BTC Correction from Highs

Bitcoin prices remain under pressure this week with the futures market sliding again yesterday, now down more than 12% from the YTD highs. The pull-back comes despite a seemingly positive backdrop following Trump’s approval of crypto to be included in 401k retirement portfolios and an increasingly dovish Fed outlook. ETF demand has cooled a little in recent weeks with some suggesting profit taking into a test of the highs. Despite recent outflows, however, ETF demand on the year remains at bullish levels and high-profile purchases continue to hit the wires with Michael Saylor’s Strategy fund announcing a fresh $340 million BTC purchase, now taking the group’s total holding to over 630k BTC.

Fed & USD Data

Given the macro backdrop does indeed look positive, the current move remains seen as a corrective adjustment in the market offering the potential for bulls to reload before price makes a fresh push higher. Looking ahead, the September FOMC could clearly act as a catalyst if the Fed does deliver a fresh rate cut while signalling the potential for further easing to come. Incoming tier-one US data ahead of that meeting will be closely watched and offers plenty of potential for volatility. The current slide could well deepen further before reaching equilibrium, meaning that near-term volatility risks remain high.

Technical Views

BTC

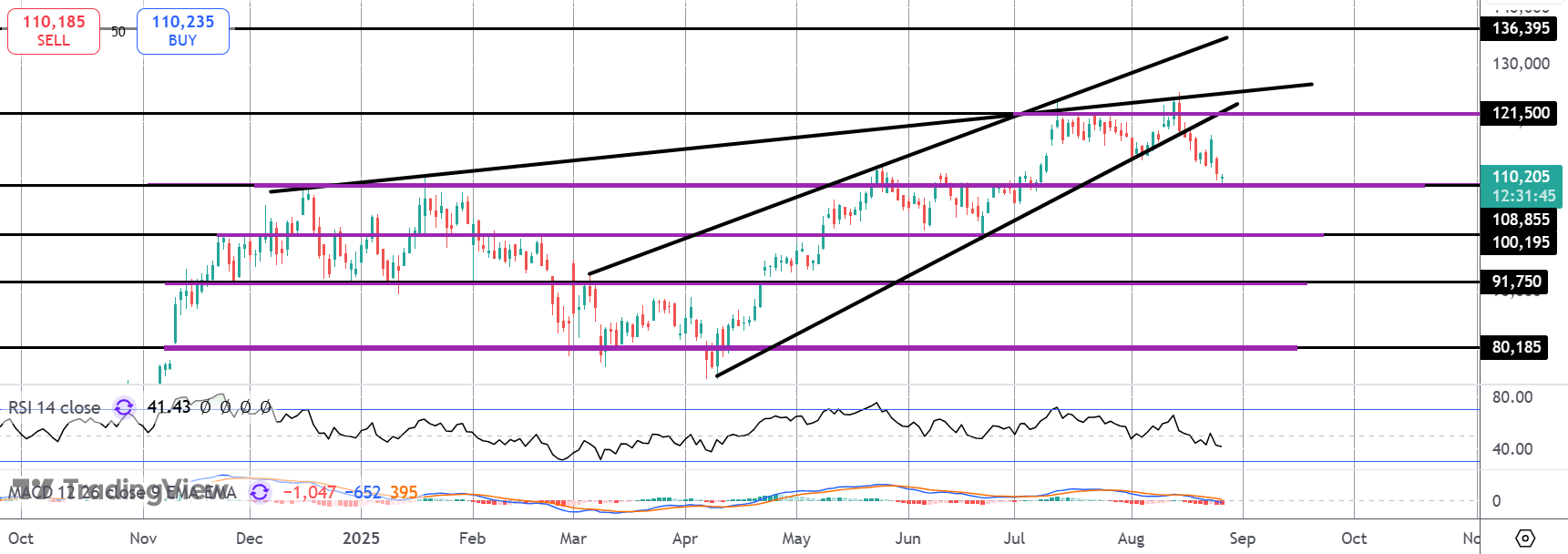

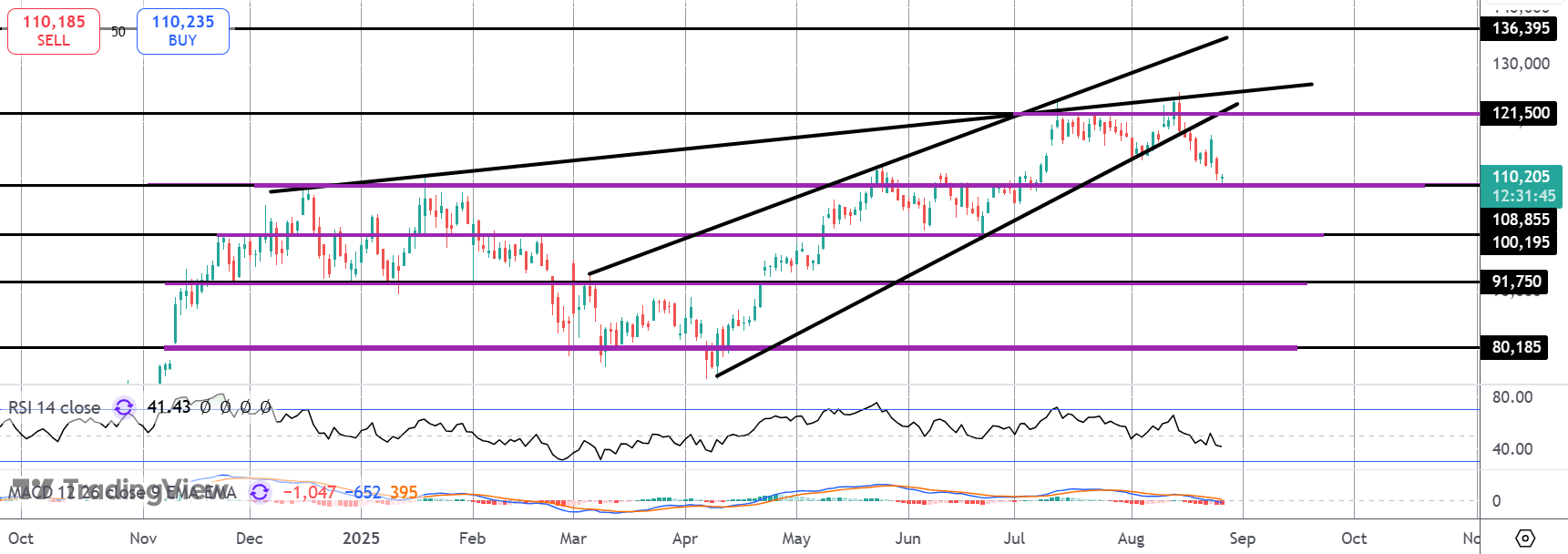

The breakdown below the bull channel and rising wedge formations has seen BTC trading back down to test support at the $108,855 level. This is a key pivot for the market and bulls need to see a bounce here to protect against a deeper test of the $100k level. Longer-term, while above $100k, the focus is on a return to upside with the $121,500 and $136,395 levels the key bull objectives to note.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.