Institutional Insights: Credit Agricole FX Weekly 11/07/25

USD: have your TACO and eat it too?

The broad USD downtrend has recently paused, signalling a potential shift in investor sentiment regarding the US economy and its asset markets. This stabilisation coincides with resilient US equity performance, elevated Treasury yields, and signs of progress in trade negotiations with key partners, which could enhance the US economic and fiscal outlook. Additionally, the fiscal stimulus enacted last week may help mitigate the negative effects of trade tariffs on US consumers.

While global trade tensions remain a concern following the 9 July deadline, their overall market impact has been subdued. Investors appear to anticipate that President Trump will ultimately deescalate any trade conflicts—a phenomenon dubbed “Trump Always Chickens Out” (TACO). Interestingly, this perception now seems to lend greater support to US assets, contributing to the USD’s steadiness.

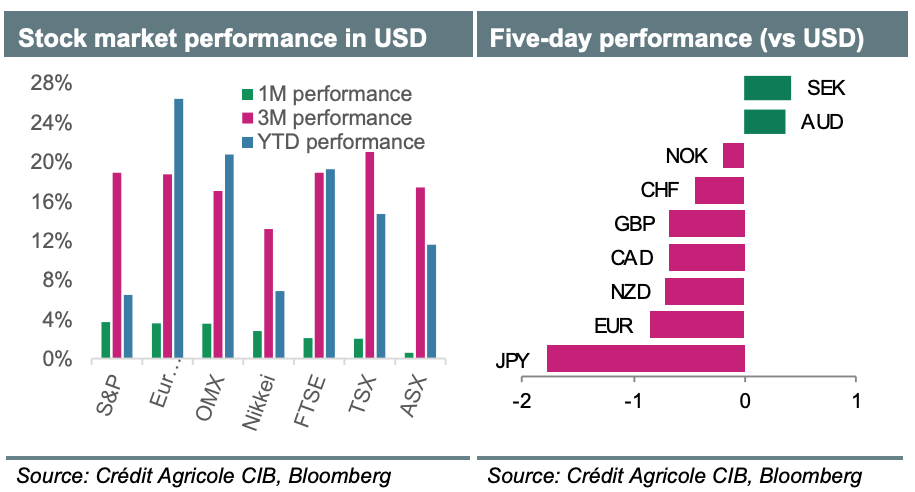

US equities have recently outperformed other G10 stock markets in USD terms for the first time since “Liberation Day.” If this trend persists, it could serve as a significant FX driver, especially since bearish USD sentiment has largely been driven by expectations of portfolio rebalancing away from the US and increased demand for short USD hedges. Furthermore, the USD appears undervalued relative to the EUR, GBP, and CHF, based on long-term fair value models.

For the USD to stage a meaningful recovery, it would require more hawkish commentary from Federal Reserve officials and positive surprises in upcoming US consumer confidence, CPI, and retail sales data. The CPI data, in particular, may garner substantial attention given differing FOMC views on the inflationary impact of trade tariffs.

Elsewhere, market focus will shift to key economic indicators from other regions, including UK CPI and labor market data, CPI figures from Canada and Sweden, labor market data from Australia, and Germany’s ZEW survey. Additionally, JPY investors will begin monitoring developments ahead of Japan's 20 July Upper House election.

FX and Gold Outlook

EUR/USD

While we have recently adopted a more optimistic stance on EUR/USD in the near term, we remain skeptical about significant EUR gains beyond current levels in 2025. Our outlook anticipates renewed EUR/USD weakness in 2026. Recent support for the EUR has largely stemmed from market expectations that it could benefit from diversification away from the USD. Additionally, hopes for aggressive fiscal stimulus bolstering the Eurozone’s economic outlook and attracting capital inflows have provided a boost to the currency. As a result, EUR/USD may remain supported for the remainder of the year. However, many of these positives are already reflected in the current EUR valuation, as indicated by both our short- and long-term fair value models. This could cap future gains and amplify downside risks for the currency over the next 6 to 12 months.

USD Outlook

The USD outlook for 2025 appears subdued, driven by investor concerns about:

1. The lingering economic impact of policies implemented during the Trump administration, which may lead to portfolio rebalancing away from USD assets and an increase in short-USD hedges.

2. The adverse effects of Trump’s fiscal stimulus package and the subsequent need to raise the debt ceiling, which could weigh on the long-term outlook for US public finances.

Despite these challenges, we do not foresee a collapse of the USD. The negative economic impact of these policies is expected to be significant yet transitory. Recovery could begin in H2 2025, with a rebound in 2026 as fiscal stimulus policies take precedence over trade concerns. This recovery may allow the Federal Reserve to avoid aggressive policy easing, particularly if inflation remains persistent. Furthermore, we doubt the USD will lose its reserve currency status. Overall, we anticipate a USD recovery within 6 to 12 months.

EUR/CHF

Safe-haven demand has strengthened the CHF, even against the resurgent EUR. While EUR/CHF may edge higher throughout the year, Switzerland’s return to zero interest rate policy (ZIRP) makes the CHF an appealing funding currency. Lower inflation differentials could temper CHF real valuations, while stable growth could help avoid significant nominal losses.

USD/JPY

We remain doubtful about major trade agreements between the US and its trading partners, positioning the JPY as a strong hedge against potential stagflation in the US. Asset managers are likely to continue diversifying away from US and Japanese assets, benefiting the JPY. However, USD/JPY faces downward pressure from anticipated Fed rate cuts and the Bank of Japan’s eventual rate hikes, which are unlikely to occur before 2026.

GBP Outlook

The GBP is expected to outperform both the EUR and USD in 2025 and beyond, partly due to the UK’s economic benefits from easing trade tensions with the US and EU. Persistent inflation in the UK could delay aggressive Bank of England rate cuts, maintaining the GBP’s rate advantage over the EUR. Moreover, recent GBP underperformance has pushed it into undervalued territory relative to the EUR, according to our short-term FX fair value model. However, renewed concerns about the UK government’s fiscal conservatism pose a downside risk to the GBP’s near-term outlook.

USD/CAD

USD/CAD has returned to levels seen a year ago near 1.36, primarily driven by broad USD selling. This retracement exceeds what relative interest rates would suggest, and any eventual trade agreement between the US and Canada could act as a catalyst for further spot pullbacks.

AUD Outlook

Investor concerns about US tariffs and global trade wars have likely peaked. A narrowed focus on trade tensions between the US and China is less detrimental to the AUD compared to a broader global trade war. China’s ongoing economic stimulus measures to counteract US tariffs will support growth, indirectly benefiting the AUD, which remains strongly correlated with the CNY. Australia’s rates market appears overly aggressive in pricing rate cuts, as a tight labor market and increased government spending post-election provide positive inflationary impulses.

NZD Outlook

New Zealand’s economy is recovering strongly from a deep recession, supported by robust agricultural export prices and production. While the absence of major US trade deals could negatively impact the NZD, diversification away from US assets will favor NZD/USD, which is positively correlated with relative Asia-US equity market performance.

NOK Outlook

Despite challenges, Norway’s strong fundamentals and the NOK’s rate appeal—despite frontloaded Norges Bank easing—suggest further appreciation in the long term, assuming global conditions remain stable. April’s correction serves as a reminder of potential setbacks in the NOK’s recovery journey.

SEK Outlook

The SEK has emerged as the surprising year-to-date outperformer among G10 currencies, leveraging its high-beta EUR proxy status. However, a softer economic patch and easing measures may limit gains. Convincing evidence of Sweden’s macroeconomic outperformance relative

Gold

Although the recent sharp gains in gold prices may discourage buyers in the short term, its momentum is likely to strengthen over the next three to six months. This potential growth is supported by increased central bank purchases and the anticipated resumption of the Federal Reserve's easing cycle, which could drive down U.S. real interest rates and weaken the USD. However, a robust rebound in the U.S. economic outlook, accompanied by higher U.S. interest rates and Treasury yields, could challenge gold’s resilience in 2026.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!