Institutional Insights: Goldman Sachs Market Sentiment & Positioning

.jpeg)

Subjective Bottom Line: The S&P 500 and NDX hit fresh all-time highs last week, even amid a sharp reversal in "Momentum." U.S. cash markets were closed from Thursday noon onward, shielding them from negative headlines about Trump’s announcement of unilateral tariff decisions for countries failing to reach a deal by July 9th. This announcement impacted European markets during the final session of the week, reigniting tariff negotiations as many had anticipated deadline extensions. Overnight news of Trump signaling an additional 10% tariff on BRICS-aligned countries further intensified tariff discussions ahead of Q2 earnings season starting next week.

With U.S. markets closed on July 4th and operating for only half a day on Thursday, some positioning data is absent from this report. However, the available updates reveal hedge funds maintained their risk-on stance for the seventh consecutive week. This trend was driven by increased shorting activity, resulting in a net sold Prime book globally. Issuance activity remained subdued, largely due to corporates being in their blackout window—a period typically marked by reduced buyback activity, especially in July.

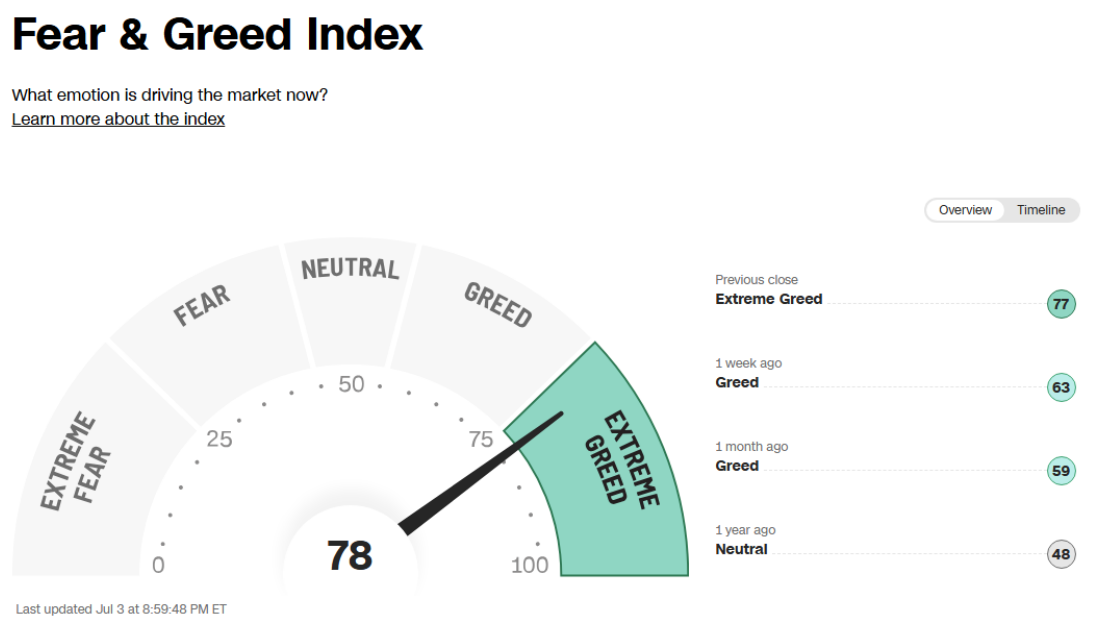

Various strategies appear to have reserves to support the market, particularly non-economic players like CTAs. According to models, CTAs could potentially inject up to $100 billion into the market in an optimal scenario over the month. Retail investors were also notably bullish, with sentiment reaching levels unseen since last December and entering Extreme Greed territory. These trends were validated by strong rallies in their favored assets: Bitcoin (+8%), Most Short (+5.24%), and Retail Favorites (+2.23%).

Hedge Funds - Prime Brokerage:

- Global: Risk-on flows persisted for the seventh consecutive week in the Global book, which ended net sold as new shorts outpaced new longs. Macro products were net sold, with shorts exceeding long sells. Single-stock flows were also risk-on, driven by new shorts surpassing new longs at a 2.4:1 ratio. Europe led buying activity, while North America was the most net sold region. The Global L/S ratio declined to 1.73x, down 0.7 points week-over-week (WoW), placing it in the 31st percentile for the past year and the 19th percentile for the past five years.

- Europe: The European L/S ratio rose to 1.79x, up 2.05 points WoW, positioning it in the 15th percentile for the past year and the 5th percentile for the past five years.

Europe:

Risk-off flows were notable in Europe this week. The book saw net buying activity, driven by short covers surpassing new longs at a 1.7:1 ratio. Macro products also experienced net buying, with short covers outpacing new longs at a 3.5:1 ratio. Conversely, single stock flows leaned toward risk-on behavior, led by new longs outpacing short covers at a 2.9:1 ratio. Europe remains overweight relative to the MSCI World Index by 3.24%, marking an increase of 0.53 percentage points week-over-week. Meanwhile, North America continues to be underweight at -8.11%, reflecting a slight improvement of 0.22 percentage points.

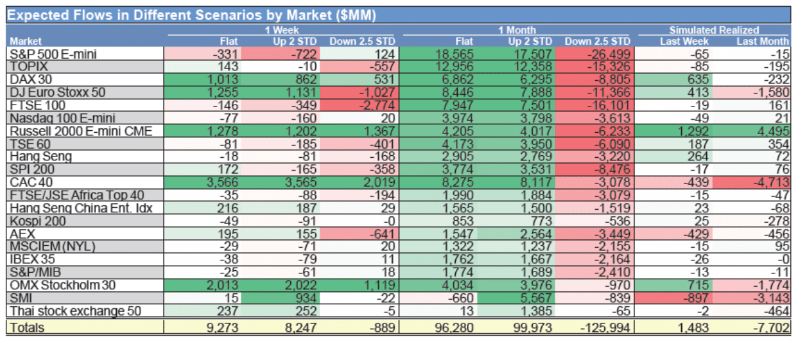

Systematic:

As of our latest update on Friday before the US market open, our models estimate that CTAs purchased $2 billion in global equities over the week, raising their overall exposure to $69.9 billion, which is at the 62.3rd percentile over the past year. Looking ahead, our models predict increased activity this week, with approximately $9.3 billion expected to be bought in a flat scenario. Extending this trend over the month, the models now anticipate $96.3 billion in purchases under a flat scenario, up significantly from last week's forecast of $52 billion for the same period.

CORPORATES: Supply (IPOs) vs Demand (Buybacks):

- Issuance: $10.71 billion worth of IPOs/Add-ons in North America during the week, bringing the year-to-date (YTD) total to $180.57 billion.

- Buybacks: According to our dedicated US buyback desk (as of June 30), activity was light this past week as corporates remain in their blackout windows ahead of earnings. Companies typically exit blackout ~1-2 days post EPS release. Last week's buyback volumes were 0.5x compared to 2024 YTD average daily trading volume (ADTV) and 0.6x versus 2023 YTD ADTV. Currently, we estimate over 85% of companies are in blackout windows, increasing to 88% by the week's end. July is generally a lighter month for buybacks due to blackout windows and reduced summer trading volumes. Next week is expected to remain slow due to the Independence Day holiday in the US.

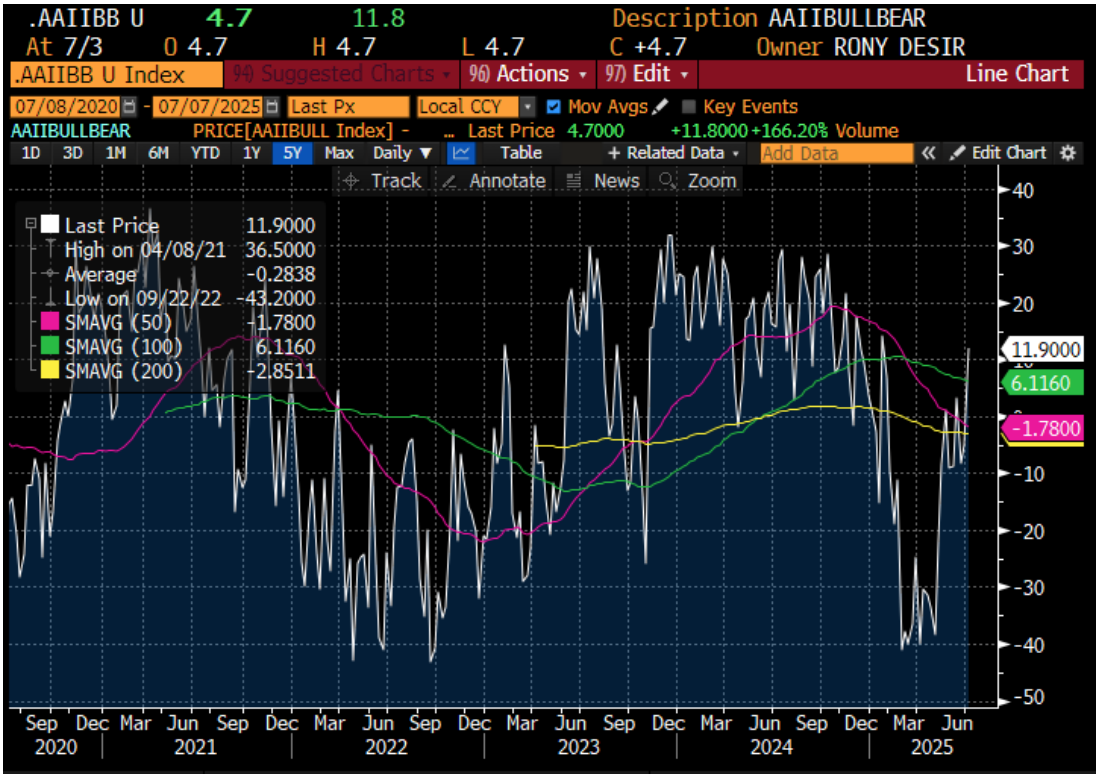

RETAIL - AAII SENTIMENT SURVEY:

- Bullish: For the week ending July 3, bullish sentiment increased by 9.90 points to 45%.

- Bearish: Bearish sentiment decreased by 7.20 points to 33.10%.

- Neutral: Neutral sentiment dropped by 2.80 points to 21.8%.

- Historical Comparison: Bullish sentiment is above the historical average of 37.5%, bearish sentiment is slightly above the average of 31%, and neutral sentiment is below the historical average of 31.5%.

The CNN Fear & Greed Index has surged into the "Extreme Greed" zone, currently sitting at 78/100, a notable increase from 65/100 just one week ago. This index aggregates insights from seven key indicators that reflect stock market behavior: market momentum, stock price strength, stock price breadth, put and call options activity, junk bond demand, market volatility, and safe-haven demand.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!