Institutional Insights: Goldman Sachs Non Farm Payroll Analysis

Goldman Sachs Research Update:

- Nonfarm payrolls are estimated to have increased by 85k in June, which is below the consensus forecast of 110k and the three-month average of +135k.

- The unemployment rate is projected to have edged up to 4.3% (rounded), slightly higher than the unrounded 4.24%, due to sequential increases in other labor market slack indicators.

- Average hourly earnings are estimated to have risen by 0.3% month-over-month (seasonally adjusted), influenced by neutral calendar effects.

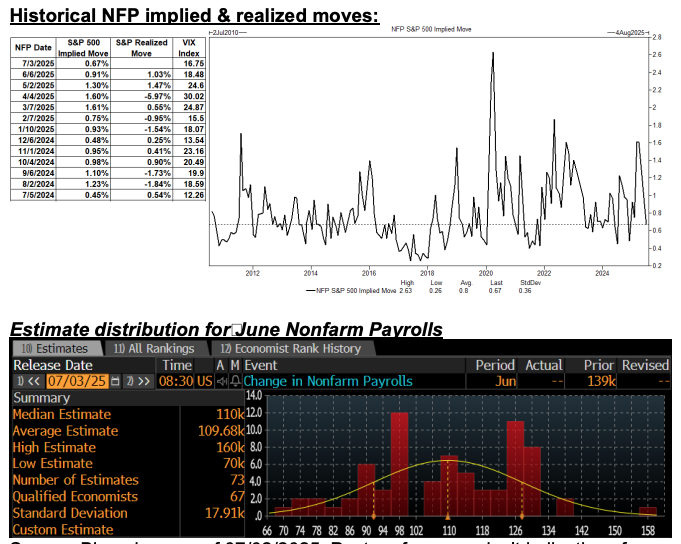

- The S&P 500 implied move through tomorrow’s close is approximately 0.67%.

Thoughts from around GS:

Vickie Chang (Global Macro Research)

As markets have stabilized, we’ve returned to a phase where data plays a more significant role, leaving markets more susceptible to negative labor market news than in recent months. The near-term risk landscape now hinges on upcoming labor market and inflation data, as well as shifts in perceptions of the Fed’s trajectory. Our growth benchmarking analysis indicates that the market is pricing in a growth outlook slightly more optimistic than our one-year forecast. However, there could still be upside potential if the market starts reflecting a more favorable 2026 growth outlook.

This suggests that while growth optimism appears more fully priced and the tailwinds from growth-related pricing seem limited, the market doesn’t seem overly exposed to growth disappointments, provided it continues to overlook short-term economic weaknesses. The real risk for assets lies in data that undermines the market’s belief that economic damage will remain contained. The most direct trigger for such fears could be a rise in the unemployment rate that invokes concerns similar to last summer’s “Sahm rule” scenario.

Equity implied volatilities and skews have returned to the lower end of their recent ranges, making downside protection more affordable. Considering the balance of risks, it may be prudent to acquire short-dated protection for long risk positions through SPX puts or put spreads ahead of key data releases.

Ryan Hammond (US Portfolio Strategy)

The equity market has surged significantly since early April, climbing 24% since the April 8th trough. Currently, the market is pricing in an optimistic yet achievable economic growth outlook. However, positioning no longer serves as a clear tailwind for equities, with our equity positioning indicator now in neutral territory (-0.1 standard deviations as of last Friday).

The rally’s breadth has been exceptionally narrow, which historically has been linked to momentum reversals. A strong non-farm payroll (NFP) report would likely support higher equity prices, as the worst growth impacts of tariffs get priced out. However, gains would likely be led by lagging sectors of the market. Conversely, with volatility at low levels, a weak NFP report could challenge investors’ ability to maintain focus on forward growth prospects, particularly given the elevated valuations of market leaders.

Shawn Tuteja (ETF/Basket Vol Trading)

Following this morning's ADP report, it seems the consensus estimate for tomorrow's NFP is around 85-95k. While there's ongoing debate over whether the headline NFP figure or the unemployment rate holds more significance, one thing is clear: the economy appears to be slowing down. Tomorrow's data will provide further insight into the pace of this deceleration.

The rates curve has already priced in potential Fed easing over the next 10 months, supported by dovish comments from various officials. In response, equities have rallied, particularly in the most cyclical sectors (see chart below). If the headline NFP comes in around 100-110k tomorrow, we could see a rotation into lesser-owned or heavily shorted areas of the market (e.g., RTY, GSXUNPTC, etc.), as the market could fully embrace the narrative of the Fed easing alongside firm economic growth—at least until the next CPI report.

In such a scenario, it will be interesting to observe how AI and momentum-driven stocks perform. Will clients hesitate to increase their exposure to these names, given their overbought and potentially expensive valuations in the broader market?

On the other hand, a sub-60k headline NFP could trigger a growth scare in the market, especially if the rates market doesn’t push the Fed to act more quickly in July. This would leave us waiting until September for the next FOMC meeting—a situation reminiscent of the growth concerns that emerged after the Fed opted not to cut rates in July despite weak data.

Joe Clyne (Index Vol Trading)

As we approach the NFP release, the market is signaling muted top-line movements, with greater focus on the momentum unwind observed on Tuesday. The NFP SPX straddle is expected to price below 60 basis points, which is somewhat surprising given that potential rate cuts could hinge on the strength of the jobs report.

The desk believes that extreme readings—whether overly strong or weak—could induce market stress. A hot jobs number would likely rule out rate cuts, while a weak report might heighten concerns about the economy's overall health. Despite the two-way economic risks, the desk favors holding mid-dated volatility, particularly on SPX topside, over short-dated gamma.

September and October 25-delta call implied vols, trading at a low 12-vol handle, appear to be the most compelling opportunities on the board right now.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!