Institutional Insights: Goldman Sachs -Systematic & Futures Update: Resumed Buying

.jpeg)

Systematic & Futures Update: Resumed Buying

FICC and Equities

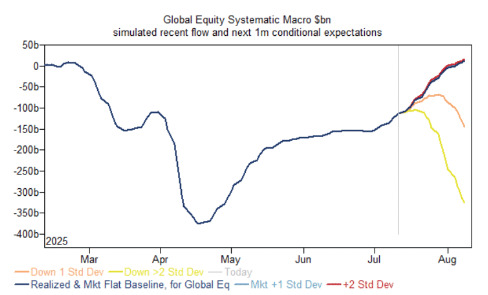

1. Systematic macro global equity positions have resumed and continue to gradually rise in light of positive trend indicators and stable or decreasing volatility. We project $25 billion in global equity purchases over the past week, $31 billion for the upcoming week, and a total of $132 billion over the next month in the baseline scenario. Of this monthly total, approximately $100 billion is anticipated to come from CTA/trend followers, with the remainder from volatility-based investors (volatility control and risk parity strategies). By region, $48 billion, or 37% of the monthly global total, is expected to be allocated to US markets. Current global equity positions are around $310 billion, slightly under a 6 out of 10, and should reach a 6 after next week’s flow, and closer to an 8 after the upcoming month’s baseline purchasing, all else being equal. The conditional/non-baseline scenarios are illustrated in Chart 1 below as usual. Additionally, liquidity levels have remained cyclically improved and are comfortably above the average for the past year. In terms of gamma, we note an overall negative trend and pro-cyclicality in hedging flows, indicating that the amount of delta to buy during an up-move generally exceeds the sell amount for a corresponding down-move, all else equal. This pro-cyclicality in potential down-moves is a newer development, contrasting with the support buying during down-moves that we observed from late May to June.

2. In industry-wide data, US equity institutional and total non-dealer net positions are at or below their one-year averages (ranging from 27% to 49%) but higher on a historical scale (74% to 78% on a min-max scale). In VIX, total open interest and the non-commercial gross share have seen a significant rise over the past several weeks since May, moving from multi-year lows to above multi-year averages. For USTs, institutional positions reflect record nominal DV01 net long holdings, while non-commercial or speculative positions are at a new record net short. Regarding FX, non-dealer US dollar net positions have remained near one-year lows, with a historical rank of 20% in recent week

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!