Institutional Insights:Global Market Intelligence (GMI) | September Outlook

Global Market Intelligence (GMI) | September Outlook, Scott Rubner

Bottom Line: Farewell to August’s Positive Fund Flow Dynamics

-

Despite maintaining a supportive near-term outlook on equities, the favorable positioning that bolstered the markets in August is expected to shift into a challenging dynamic after Labor Day. With systematic strategies nearing peak equity exposure, negative seasonal trends emerging, and volatility typically increasing, implementing downside equity hedges appears to be a timely strategy amid a crowded macro calendar.

Snapshot

Historically, September ranks as the weakest month for equities, characterized by rising volatility and diminishing retail engagement. As systematic strategies—such as CTAs, Vol-Control, and Risk Parity—approach their maximum allocations, coupled with a decline in corporate demand, the risk/reward balance tilts negatively, rendering hedges appealing. Nonetheless, the long-term trend remains intact and supportive of a potential Q4 rally.

On-the-Ground Sentiment (Citadel Securities)

Client activity remains robust at record equity market levels, even the Dow

Jones Industrial Average made a new high — a key benchmark for

household / 401k sentiment.

• Retail Equities: Retail net buyers in 16 of the last 18 weeks

• Retail Options: 16-week net buying streak, 17 of last 18 weeks

• Institutional Options: Bullish tone in 5 of the last 7 weeks

II. This Week’s Strategic Debate: Can record options activity persist?

• Equity option contract volumes tracking all-time highs.

• 0 days-to-expiry (0DTE) flow continues to expand.

• 71M option contracts traded on Friday (per OCC)

• 58M option contracts YTD 2025.

I believe this surge is structural, not cyclical — a reflection of consumer health and market engagement, not a passing fad.

Seasonality Watch: Q3 Asset Allocation Rebalancing

September Setup

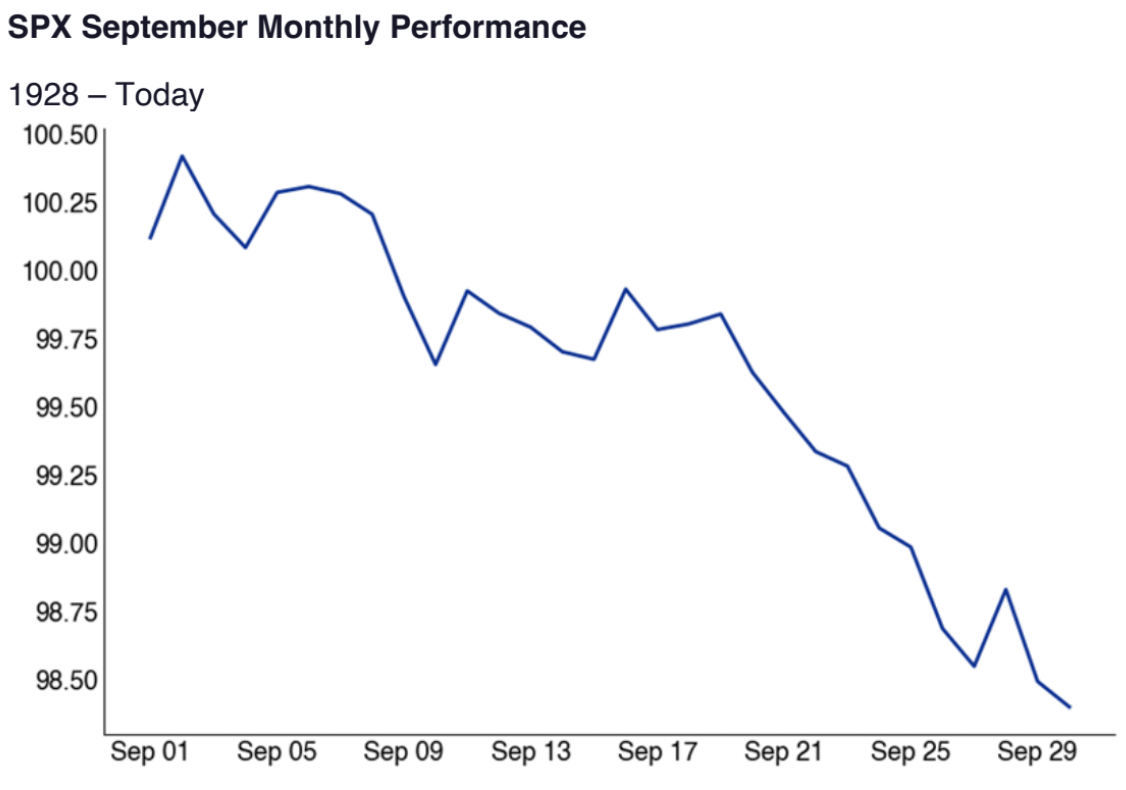

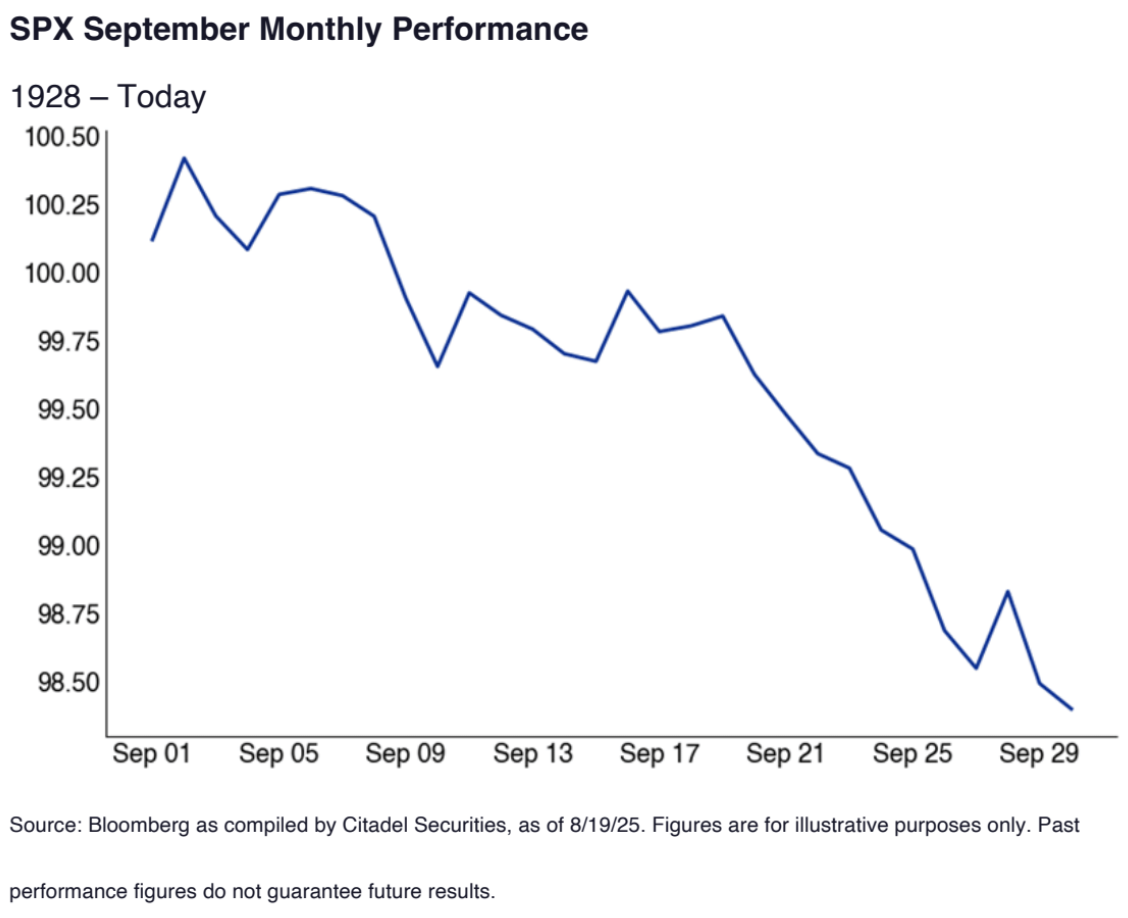

September 3rd has historically marked the monthly high for SPX since

1928. Post-Labor Day FOMO tends to fade curtailing buy the dip flows.

•Quarter-end portfolio rebalancing intensifies in September.

•2025 has closely mirrored the historical composite pattern

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!