Market Spotlight: Kape Shares Soar on Takeover Bid News

Kape Higher on Monday

Shares in Kape Technologies are trading sharply today as the stock gapped higher at the London open on news of a takeover bid. Majority shareholder Unikmind Holdings has reportedly offered $1.51 billion to purchase all remaining shares in the company ($3.44 per share). Unikmind, owned by Teddy Sagi, is unable to purchase further shares in Kape until March 31st or the release of full-year 2022 results. However, Kape is pushing for Unikmind to be released from the agreement so that the offer can be put to shareholders.

Correction Offers Buying Opportunity

Kape shares are currently down around 35% from their all-time highs, falling as part of the broader sell off in tech over the last year. However, with sentiment quickly shifting back towards bullishness, Unikmind are looking to benefit from the projected rally by taking over Kape. The digital security software provider has seen a strong shift in performance over recent years moving out of net annual losses into profitability and as such the recent decline likely looks like an attractive discount to buy at for Unikmind. Notably, Unikmind (which owns roughly 55%) is seeking a delisting of Kape from AIM regardless of whether the offer is accepted.

Technical Views

KAPE

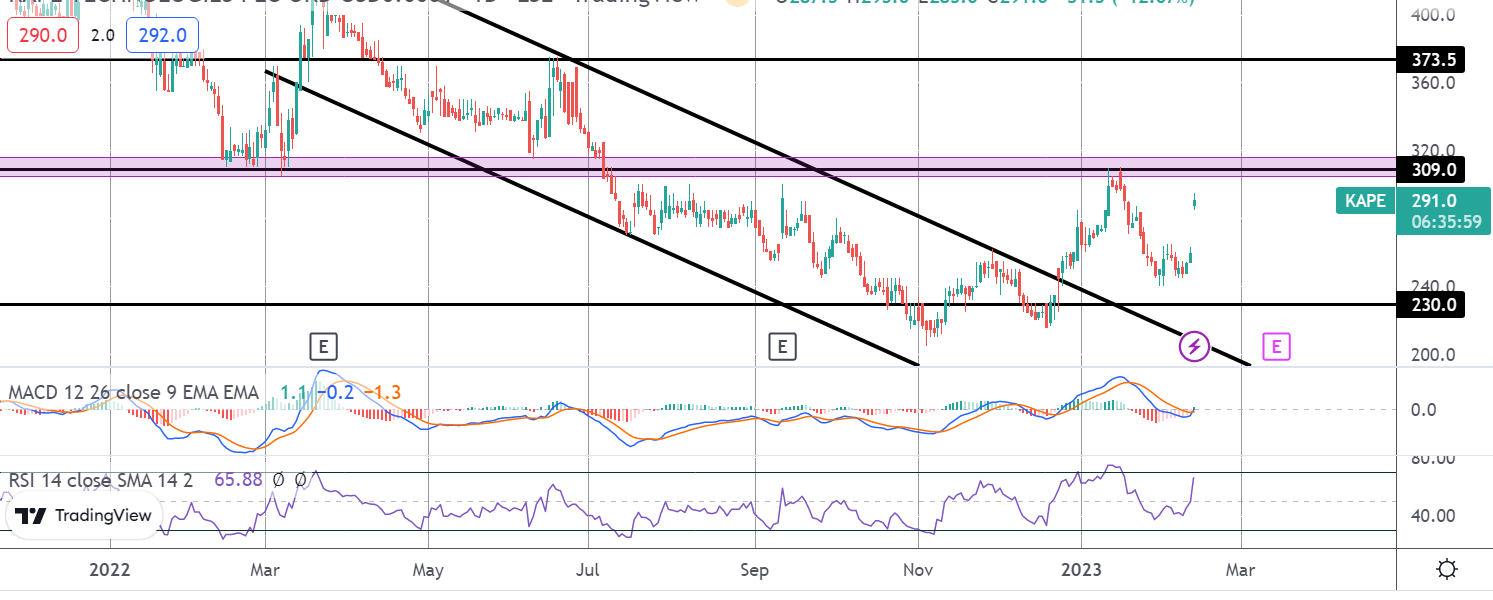

Following the failure and subsequent reversal from the 309 level, Kape shares have since rebounded are now trading back up towards the level. This is a key near-term pivot for the stock. With momentum studies turning bullish, a break of current highs will open the way for a move higher towards the 373.5 level thereafter.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.