Nasdaq Plunges As Global Tech Outage Hits

Nasdaq Under Pressure

The Nasdaq remains firmly offered on Friday with the E-mini futures market now down around 5% from the record highs printed last week. There are a number of factors weighing on tech stocks here, uncertainty around the US elections, a stronger US Dollar this week and today the global tech outage linked to Microsoft systems which has hit sentiment hard. Against this backdrop, tech stocks look likely to remain pressured near-term as traders await clarity on these issues.

US Elections Impact

The prospect of Trump returning to power in the US has become a bigger focus point over the last week on the back of his attempted assassination at the weekend. Coupled with a series of alarming public appearances from President Biden, traders now sense a much stronger likelihood of Trump returning to office. Given the risk of Trump exacerbating the geo-political unrest seen around the world, risk sentiment has weakened sharply with USD finding a firm safe-haven bid this week despite increasingly dovish Fed expectations.

Global Tech Outage

News of a global tech outage today has hit stock sentiment hard. A vast number of systems including those used by banks, airlines and hospitals went down today reportedly due to a systems failure at Microsoft. Given the already tone to risk markets this week the news has seen the Nasdaq heavily sold and looks likely to keep the index pressured through the weekend as Microsoft resolves the issue.

Technical Views

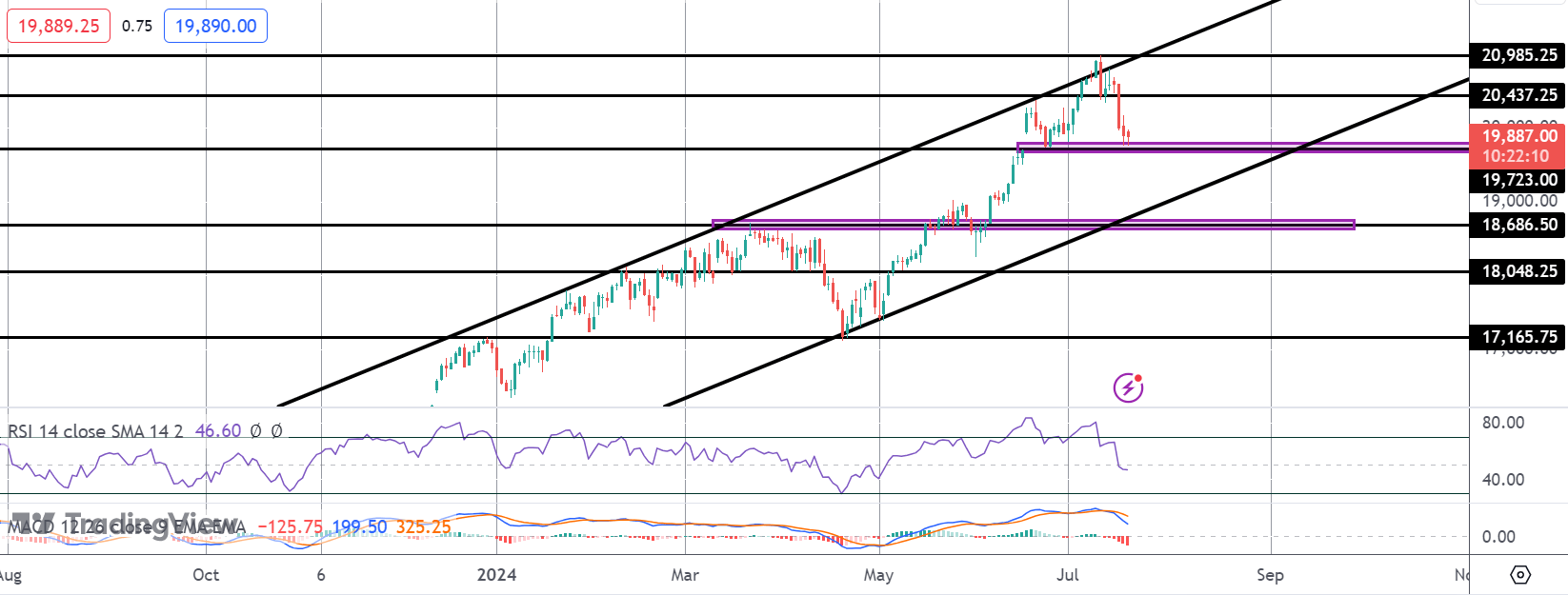

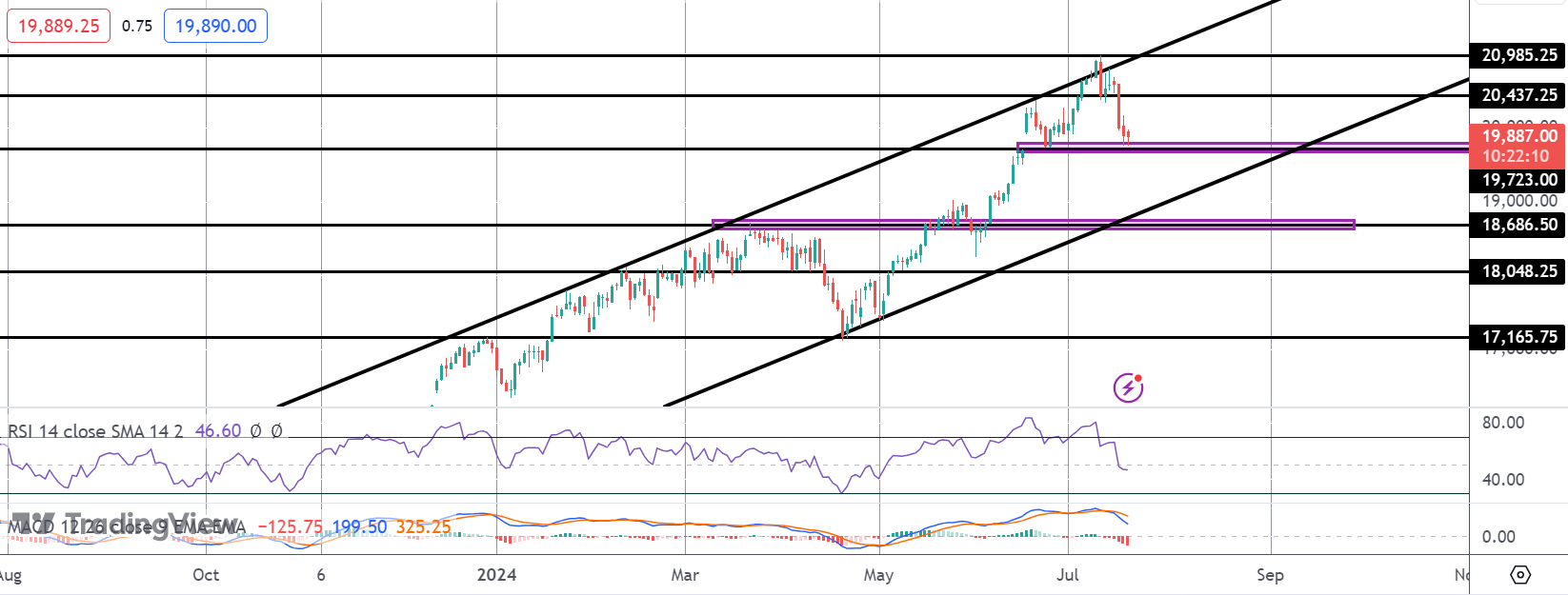

Nasdaq

The failure in the Nasdaq around the bull channel highs and 20,985.25 level has seen the market reversing sharply lower. Price is now testing the 19,723 level. This is a major support zone for the market which, if broken, opens the way for a much deeper move towards 18,686 in line with bearish momentum studies readings.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.