Nasdaq Suffers Worse Daily Loss Since 2022

Nasdaq Plunges

The Nasdaq suffered its largest one-day loss yesterday since October 2022, with the index shedding around 3.69% on the day. The plunge was mainly linked to bearish sentiment on the back of weaker-than-forecast results from Tesla and Google. Disappointing results further weakened confidence among big tech names fuelling a sharp unwinding of positions as traders question the expected profitability of AI investments.

S&P Down Too

Losses weren’t just limited to the techs sector either. There was widespread weakness in stock markets yesterday with the S&P suffering heavy losses too in response to earnings misses within the consumer discretionary space and some stark warnings over demand in the restaurant sector.

Fed Easing Expectations

The sell off in stocks comes despite a strong uptick in Fed easing expectations. The market is now pricing in an initial cut in September along with two further cuts ahead of year-end. However, with uncertainty around the US elections landscape dominating focus currently, easing expectations are not offering the support they might typically.

US Data on Watch

Looking ahead, focus over the remainder of the week will be on key US data (preliminary Q2 GDP, weekly unemployment claims today, core PCE tomorrow). Any fresh weakness should underpin easing expectations though, given the negative sentiment gripping markets currently, any rebound is expected to be minor.

Technical Views

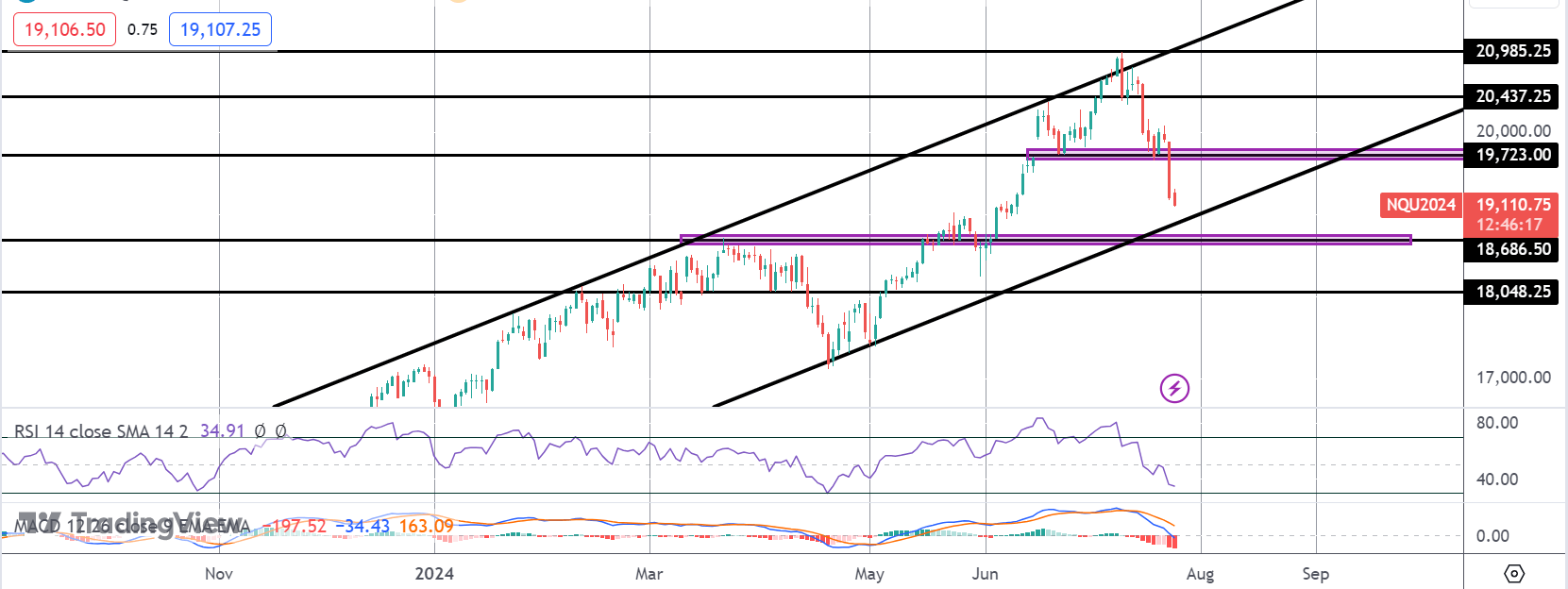

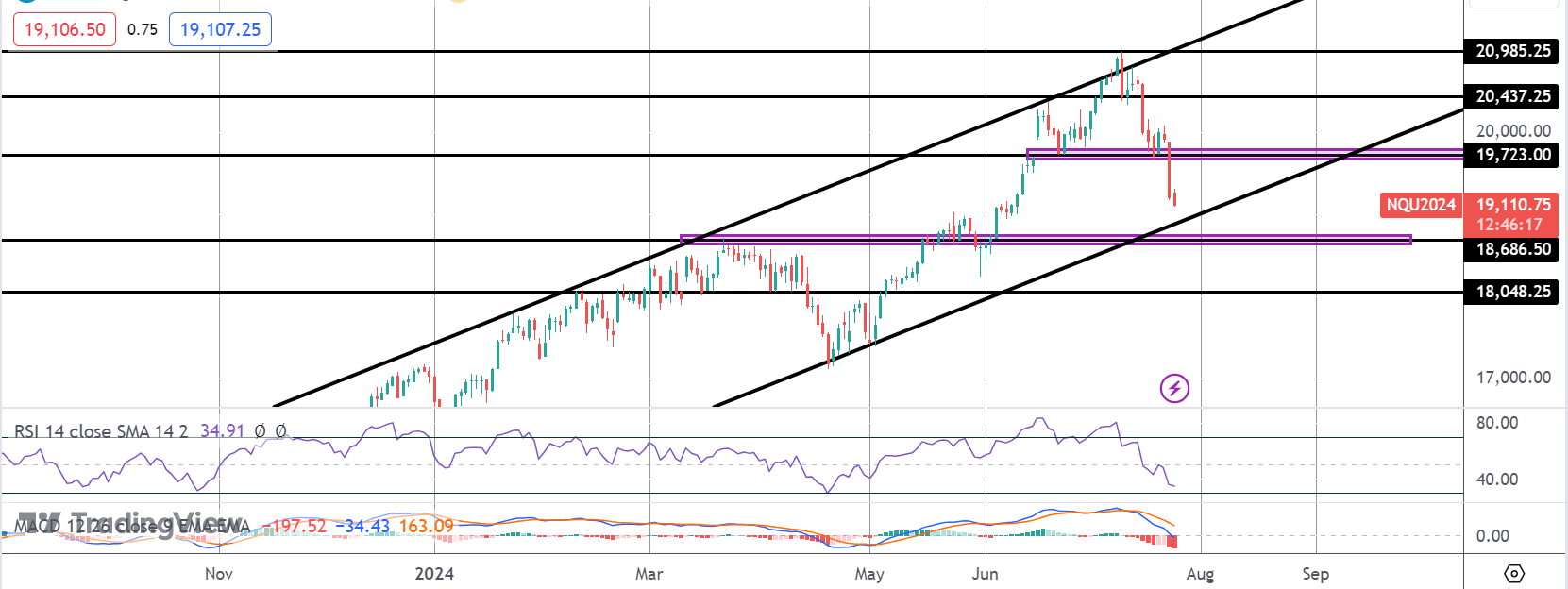

Nasdaq

The sell off in the Nasdaq has seen the index breaking sharply lower. Price plunged below the 19,723. Level yesterday and is now close to testing the bull channel lows and the 18,686.50 level beneath. With momentum studies bearish, focus is on continued downside for now.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.