New All-Time Highs in Bitcoin

BTC Testing New Highs

Bitcoin is on watch today after the futures market broke out to fresh all-time highs of $125,300. The move comes on the back of Tuesday’s weaker-than-forecast US inflation data which has helped underpin risk sentiment through the week. Despite the initial push higher, BTC has found selling interest into highs with price since reversing back below the prior $123,710 highs. As such, risks of a double top are still seen, particularly given the strong bearish divergence we’re seeing in momentum studies.

ETF Demand & Trump 401k Approval

Bitcoin prices have risen sharply this month with the futures market rallying more than 11% off the month’s lows. The move higher comes against a backdrop of growing political support and mainstream uptake. Trump signing an executive order to allow for BTC to be included in 401k portfolios marks a major milestone for the crypto community and if pension fund demand starts to grow this could help drive BTC firmly higher. Indeed, institutional demand has been a key upside driver for BTC with BTC ETF’s continuing to see soaring demand. Total net assets for BTC ETFs reached $170 billion this month as prices pushed higher. The Bitcoin market now stands at around $2.5 trillion in total, making it the fifth largest global asset class.

Trump-Putin Talks

Looking ahead, traders will be monitoring incoming news-flow around Trump’s meeting with Putin. If any progress is made, this should be firmly bullish for risk sentiment, helping lift BTC prices further near-term. If talks fail, however, this could fuel some long-covering in BTC as risk assets recoil near-term.

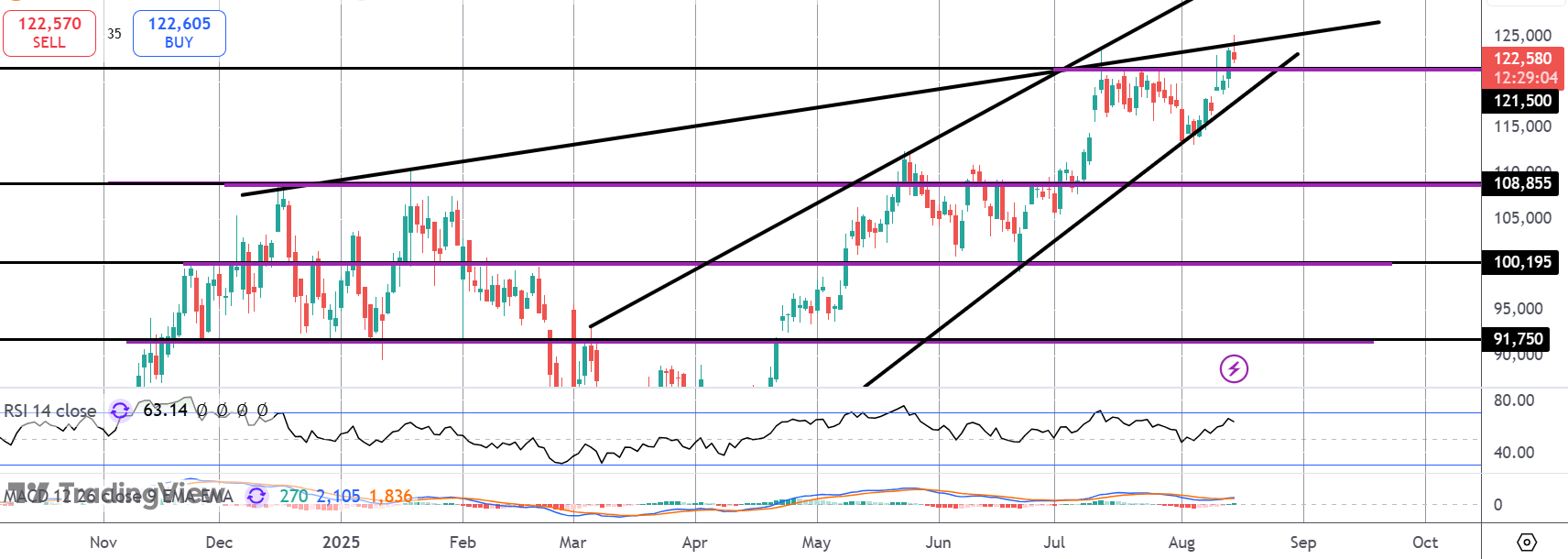

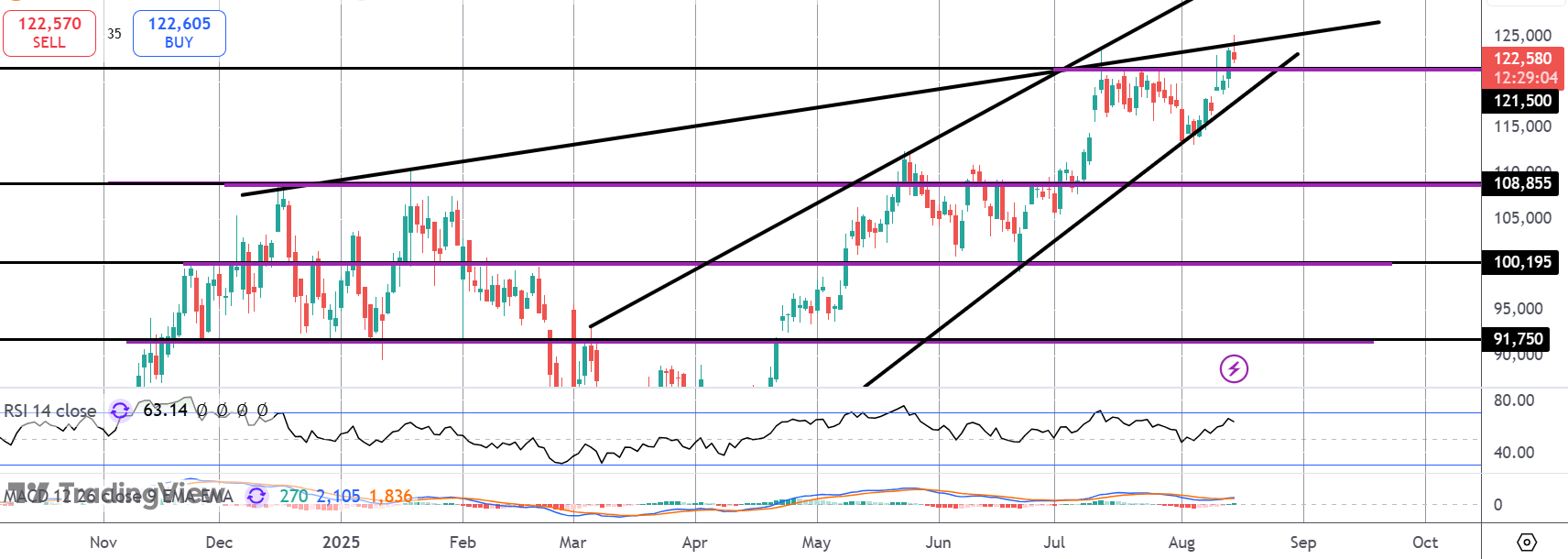

Technical Views

BTC

The rally in BTC has stalled again into a further test of the rising wedge resistance line around the prior 2025 highs. With strong bearish divergence, risks of a correction lower are seen if we break back below the $121,500 level. While above that level, focus remains on a further breakout into new highs.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.