New Record Highs Soon for Copper?

Copper Rally Stalls

The rally in copper prices has stalled for now into the 5.12 mark with the futures market heavily sold through early European trading on Friday. Copper pries have been firmly higher this month with the futures market breaking out above the 4.8010 level, posting an almost 14% gain on the month.

Supply/Demand Developments

The rally has been in driven in part by the weakness in USD over the last month but also by supply issues and building demand pressures. Issues within the copper supply chain in Chile have created upward price pressures this year which look likely to continue near-term at least. Ageing sites, some closed and some requiring heavy repairs have slowed the supply from the world’s largest copper producer. With demand expectations lifting in China, this dynamic is feeding into bullish sentiment. Additionally, it looks as though tariff risks are helping further support copper here by placing greater strain on supply chains. As such, the near-term copper outlook remains bullish.

USD Risks

The only caveat to that is if we see a proper recovery in USD near-term. An upward revision to the Fed’s inflation forecasts and concerns over Trump’s trade war have seen USD turning higher this week. If the recovery gains traction, particularly if inflation data starts to rise higher, copper prices could come under heavier pressure near-term.

Technical Views

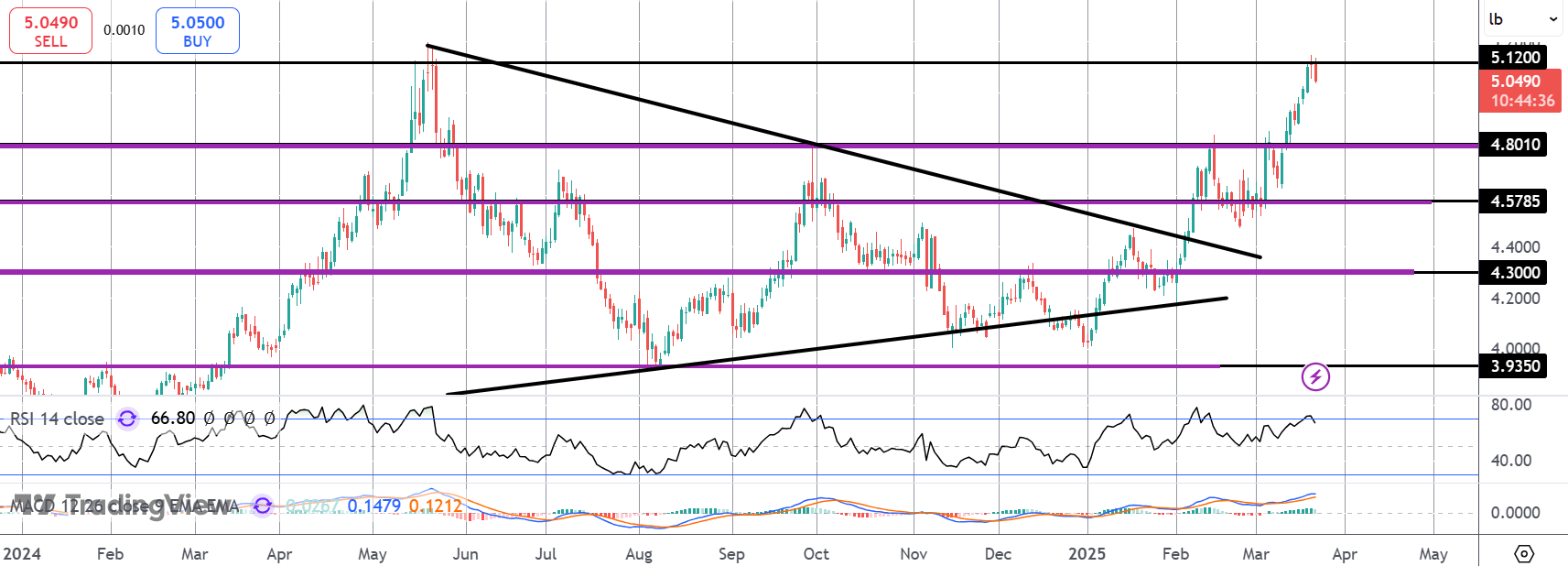

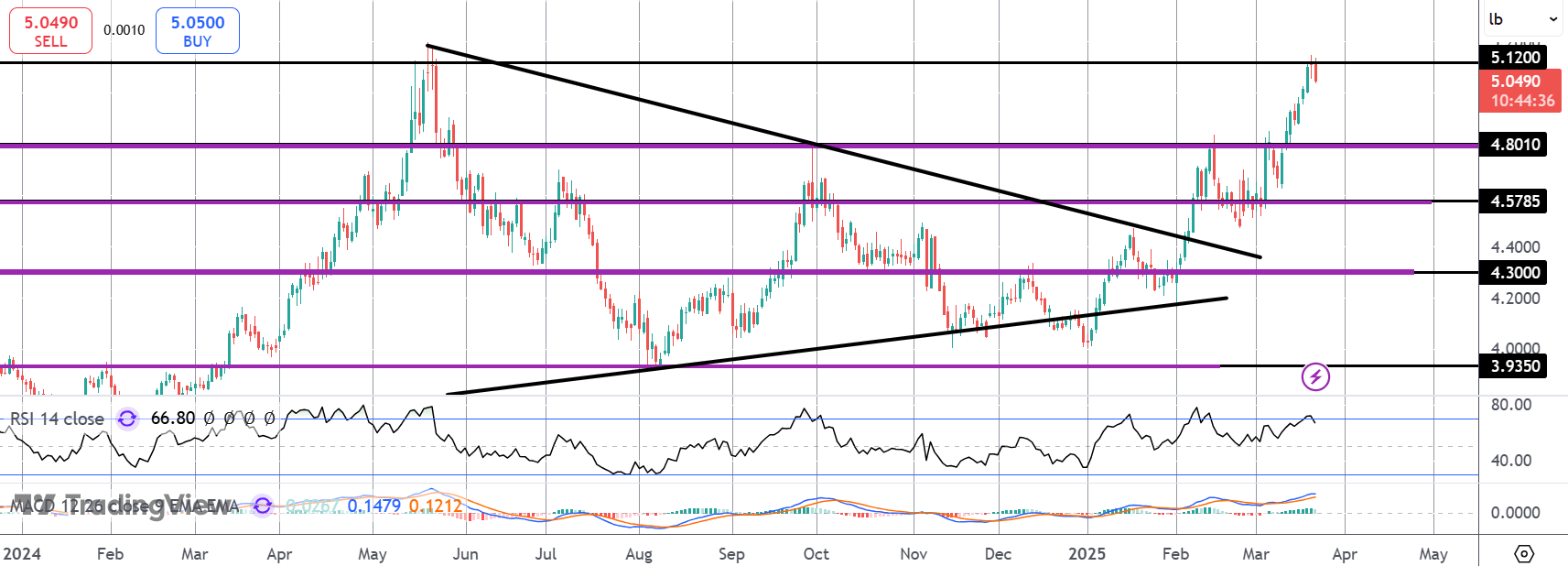

Copper

The rally in copper has stalled for now into the 5.12 level. With momentum studies fading, risks of a deeper correction are growing. However, while price holds above the 4.8010 breakout level, focus remains on a continuation higher and an eventual breakout above 5.12.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.