Potential Double Top In Bitcoin Ahead of US CPI

BTC Reverses From Highs

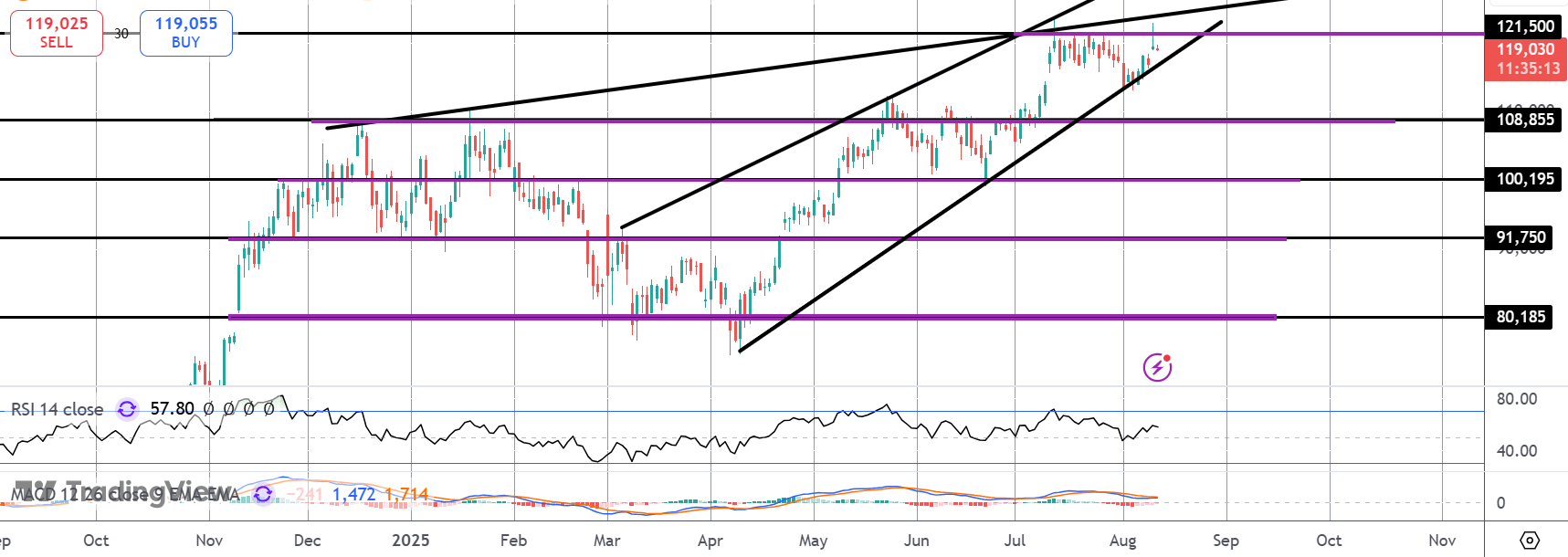

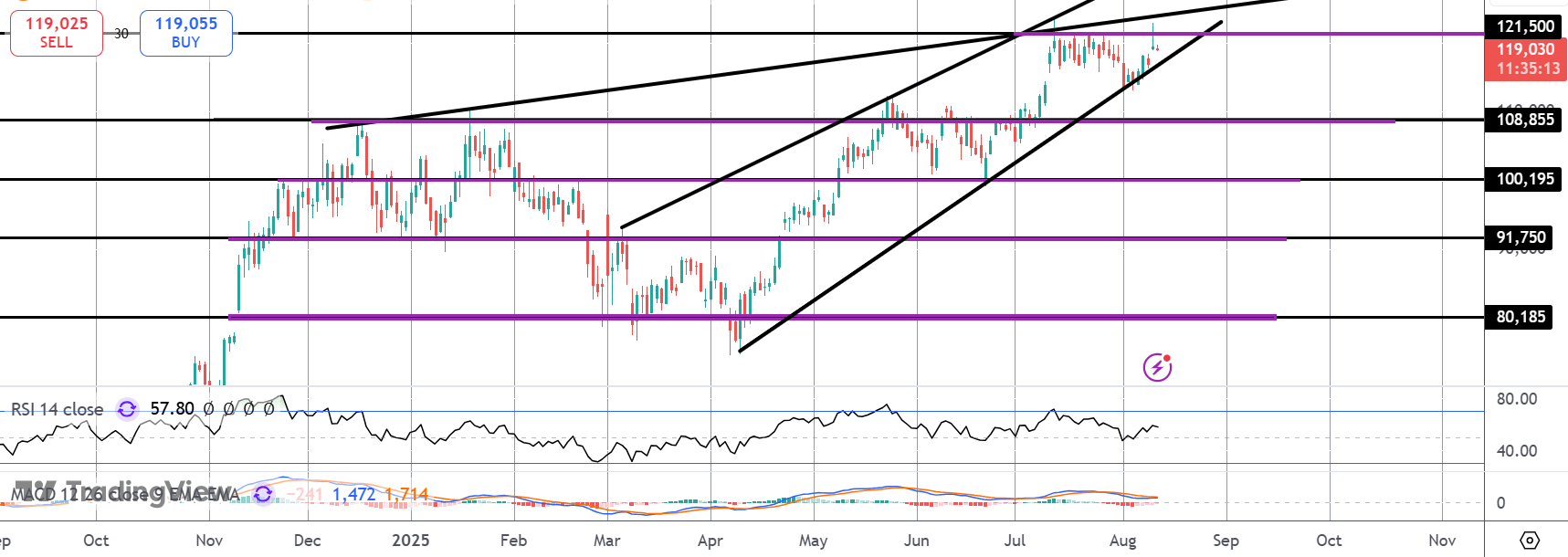

Bitcoin prices are on watch today with the futures market flashing potential reversal signals. Following a strong rally initially yesterday, BTC prices reversed heavily lower with the daily candle printing a large bearish pin bar. The market is now at risk of forming a double top against the YTD highs, with heavy bearish divergence in momentum studies readings, while also at the apex of a rising wedge formation (bearish reversal structure). In light of this, technically at least the market looks primed for some corrective action.

US Inflation Due

In terms of how US inflation data could impact BTC today, the broad strokes are that an upside print should dilute Fed easing expectations, pushing USD higher while weighing on crypto and the broader risk complex. If data is only mildly higher, as expected, this should lead to a muted reaction across markets with BTC likely to remain skewed gently lower for now. On the other hand, if data comes in below forecasts today, this will be firmly bullish for crypto, strengthening the market’s dovish Fed view and leading USD lower consequently. In this scenario, BTC could well breakout to fresh highs depending on the scale of the move we see in USD.

Technical Views

BTC

The latest attempt at breaking out above the $121,500 level has failed with price capped here again, now at risk of a double top forming. If we break below current trend line support, focus is on a test of deeper support at $108,855, in line with bearish momentum studies readings. Bulls need to defend this level to maintain the broader bull view.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.