SNB Underwhelms With .25% Rate Cut

SNB Cuts by .25%

The Swiss Franc failed to break lower today on the back of the latest rate reduction from the SNB. The Swiss bank cut rates by a further .25%, taking the headline rate down to just 1%. However, on the back of the Fed’s more aggressive .5% cut, it seems traders were left underwhelmed by the adjustment, perhaps looking for the bank to follow in the Fed’s footsteps with a larger cut. Along with the smaller .25% cut, the tone of the meeting statement was seen as less dovish than many were expecting.

Strong Franc

Against the backdrop of a strong Swiss Franc, traders were looking for a more definite tone on further rate cuts. However, looking ahead, outgoing SNB chief Jordan simply signalled that further rate cuts “may become necessary.” On the back of the meeting, the market is pricing in one further rate cut in December of .25%. However, if we see the Swiss Franc moving higher in coming months, this outlook could switch in favour of a larger .5% cut. Near-term, the CHF looks vulnerable to further strength against USD, particularly if incoming US data highlights further weakness, bolstering expectations for a further Fed rate cut in November.

Technical Views

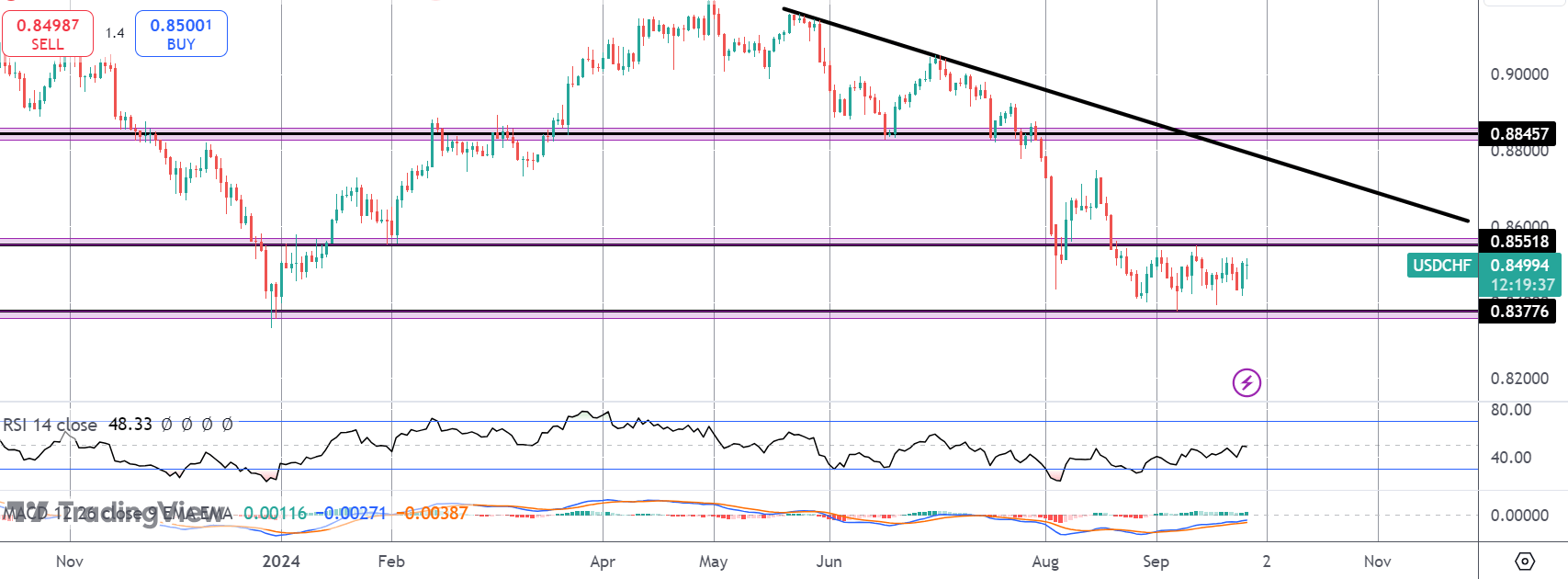

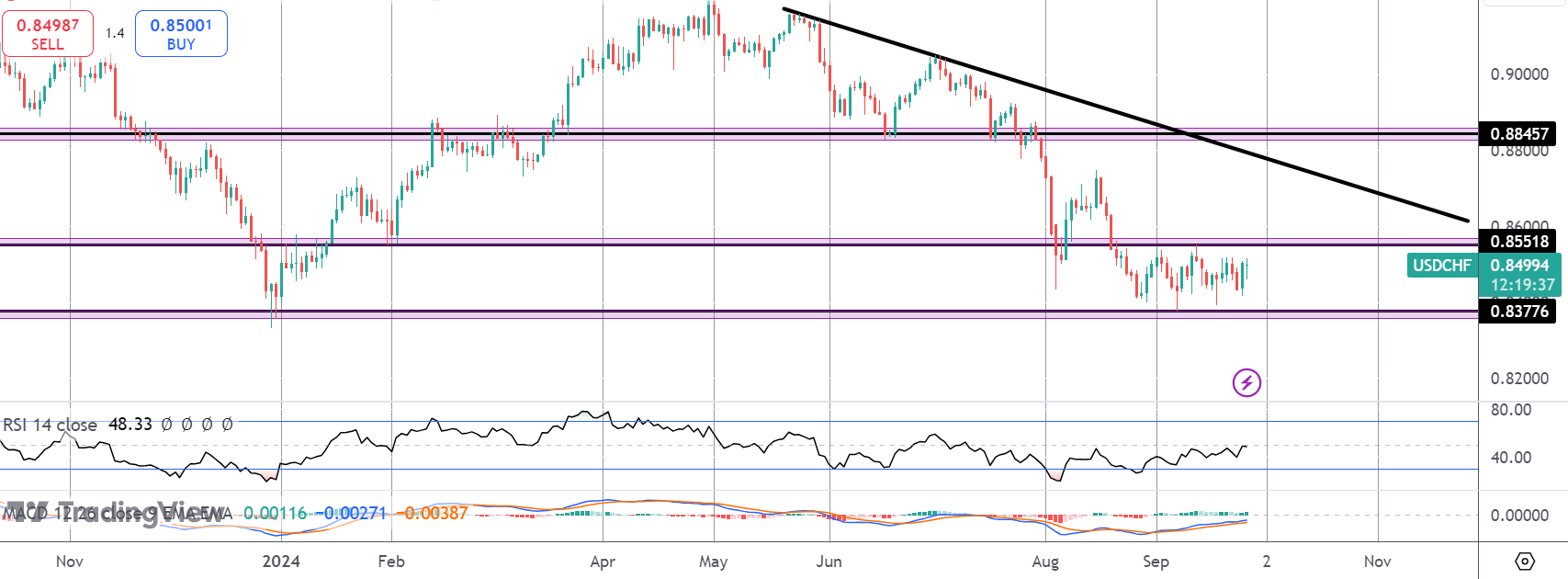

USDCHF

For now, the Swissy remains stuck in a tight range between .8377 - .8551, sat at the foot of the recent declines. Momentum studies have turned positive, suggesting room for a correction higher, targeting a test of the bear trend line and .8845, while a break down through lows will encourage fresh downside momentum.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.