SP500 LDN TRADING UPDATE 7/1/26

WEEKLY & DAILY LEVELS

***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***

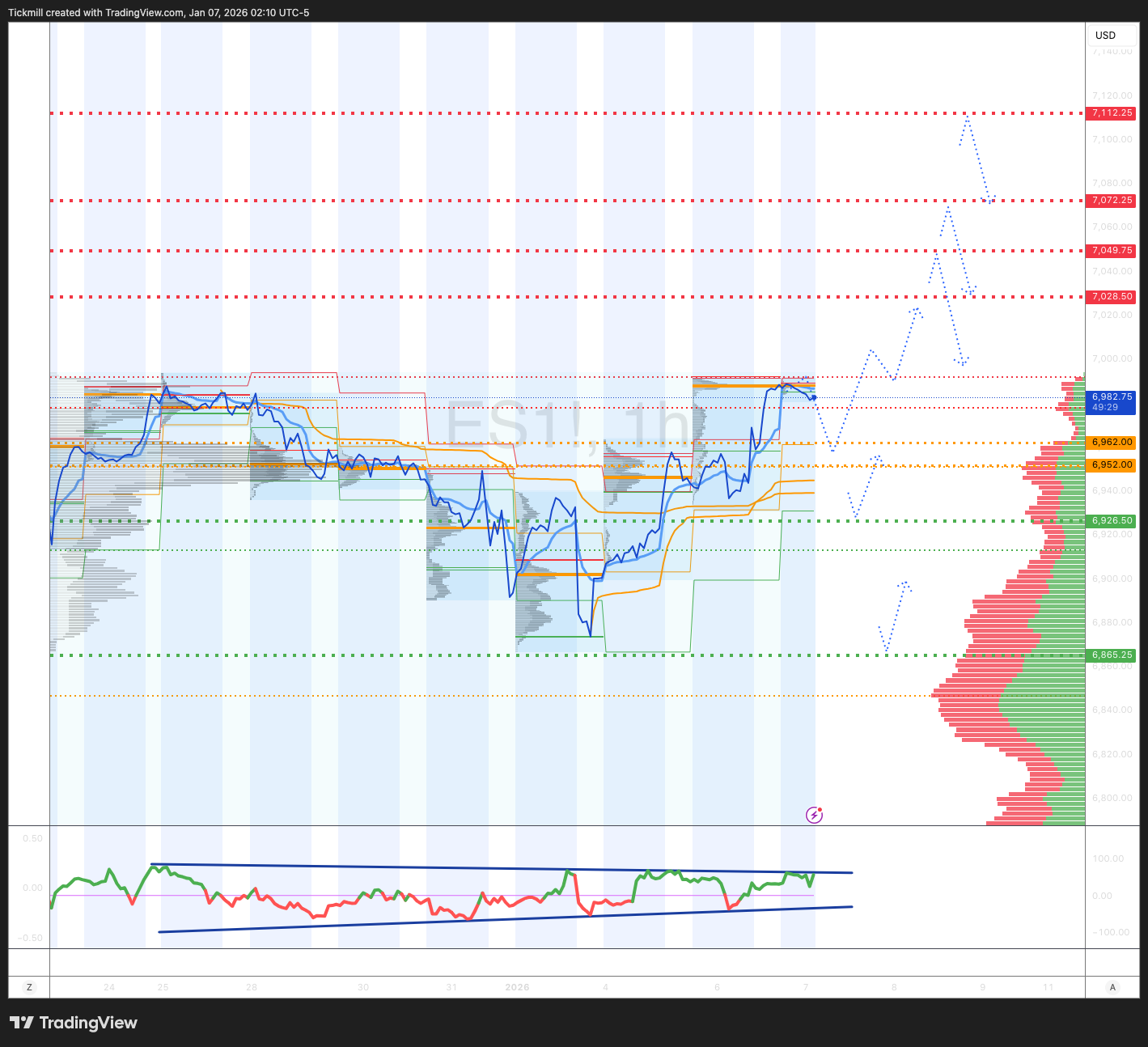

WEEKLY BULL BEAR ZONE 6970/80

WEEKLY RANGE RES 6984 SUP 6817

JAN OPEX STRADDLE 6661/7008

MAR QOPEX STRADDLE 6466/7203

DEC 2026 OPEX STRADDLE 5889/7779

WEEKLY VWAP BULLISH 6882

MONTHLY VWAP BULLISH 6845

WEEKLY STRUCTURE – BALANCE - 6866/6994

MONTHLY STRUCTURE – ONE TIME FRAMING HIGHER - 6775

The SPX aggregate gamma flip region is around 6870. The upside gamma rises sharply from 6930 and above. Conversely, below 6770, it drops sharply to the downside

DAILY STRUCTURE – BALANCE - 6866/6994

DAILY VWAP BULLISH 6931

DAILY BULL BEAR ZONE 6962/52

DAILY RANGE RES 7049 SUP 6926

2 SIGMA RES 7112 SUP 6865

VIX BULL BEAR ZONE 17.6

PUT/CALL RATIO 1.11

TRADES & TARGETS

PRIMARY PLAY - LONG ON REJECT/RECLAIM DAILY BULL BEAR ZONE TARGET 7028 > 7049

SHORT ON REJECT/RECLAIM 7028 OR 7049 TARGET 7000

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE ABOVE OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEW - RALLY EXTENDED

S&P rose +62bps to close at 6,945, with a MOC of $1.3bn to SELL. NDX gained +94bps to finish at 25,640, R2K advanced +137bps to 2,583, and the Dow climbed +99bps to 49,462. Total trading volume across US equity exchanges reached 18.73b shares, surpassing the YTD daily average of 16.55b shares. The VIX dropped -101bps to 14.75, WTI Crude fell -238bps to $56.94, while the US 10YR yield remained unchanged at 4.16%. Gold increased +98bps to 4,493, the DXY rose +34bps to 98.60, and Bitcoin declined -64bps to $93,500.

The equity rally continued, led by materials, healthcare, industrials, and discretionary sectors, while mega-cap tech underperformed (-373bps vs NPT). Within tech, memory stocks stood out with heightened volumes (SNDK, WDC, MU), driven by positive commentary from SNDK, strong institutional buying, and robust global retail demand. This created a positive feedback loop as Asia's memory sector gains influenced US markets, which in turn fueled further gains in Asia. However, pinpointing single-stock volatility drivers remains challenging (e.g., re-grossing, retail activity, factor rotations, inflows).

Key pair trades remained in focus: Software vs. Semis declined -285bps today and is now down -11% YTD, while cyclicals vs. defensives gained +167bps today and is up +5% YTD. We believe the latter trade has further upside potential. Overall activity levels on the floor were rated a 6 out of 10, with the floor finishing +235bps to buy compared to a 30-day average of -100bps. Long-only funds and hedge funds were modest net buyers, with overlapping demand in Financials. Desk flows were concentrated in consumer (hedge fund re-grossing/covering), energy (two-sided flows due to a conference), and tech.

Looking ahead, tomorrow’s key events include Nov JOLTS, Dec ISM Services, and Oct Durable Goods data releases. Additionally, CES in Las Vegas will feature presentations from companies like Helm.ai, CRDO, Tensor Auto, MBLY, and Hyundai Motor, while the GS Energy Conference will include the US Secretary of Energy and Chris Wright.

In derivatives, we observed clients fading the volatility move by selling 3-6m SPX vol. While current vol levels don’t seem excessively high, we favor the front end. Customer activity has slightly increased, with growing interest in broadening trades, though flows have not yet reached a highly aggressive level..

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!