Will USD Make A Fresh Move Lower This Week?

Dollar Remains Pressured

The US Dollar remains under pressure as we start the new week with DXY sitting just above the three-year lows printed on Friday. Uncertainty around Trump’s tariff agenda, his unpredictable shifts in sentiment and the continued escalation of the trade war with China, mean that investors are turning away from the US Dollar for now, favouring gold and other safe-haven assets. Fears over the health of the US economy, as well as expectations of forthcoming Fed easing on the back of last week’s soft inflation data, mean that negative sentiment is likely to persist in USD.

US Data, Powell & ECB

Looking ahead this week, along with incoming trade headlines, traders will also be watching the next key US data release with retail sales due on Wednesday followed by comments from Fed chairman Powell. On Thursday, focus will then shift to the ECB where the bank is now widely expected to cut rates again in response to the recent market volatility and rising uncertainty we’ve seen. If the bank is seen to signal the likelihood of further easing to come, this cold lead to some short-term selling in EURUSD. However, the broader focus will remain on trade headlines and with that, the risks of a fresh lower in USD remain elevated near-term.

Technical Views

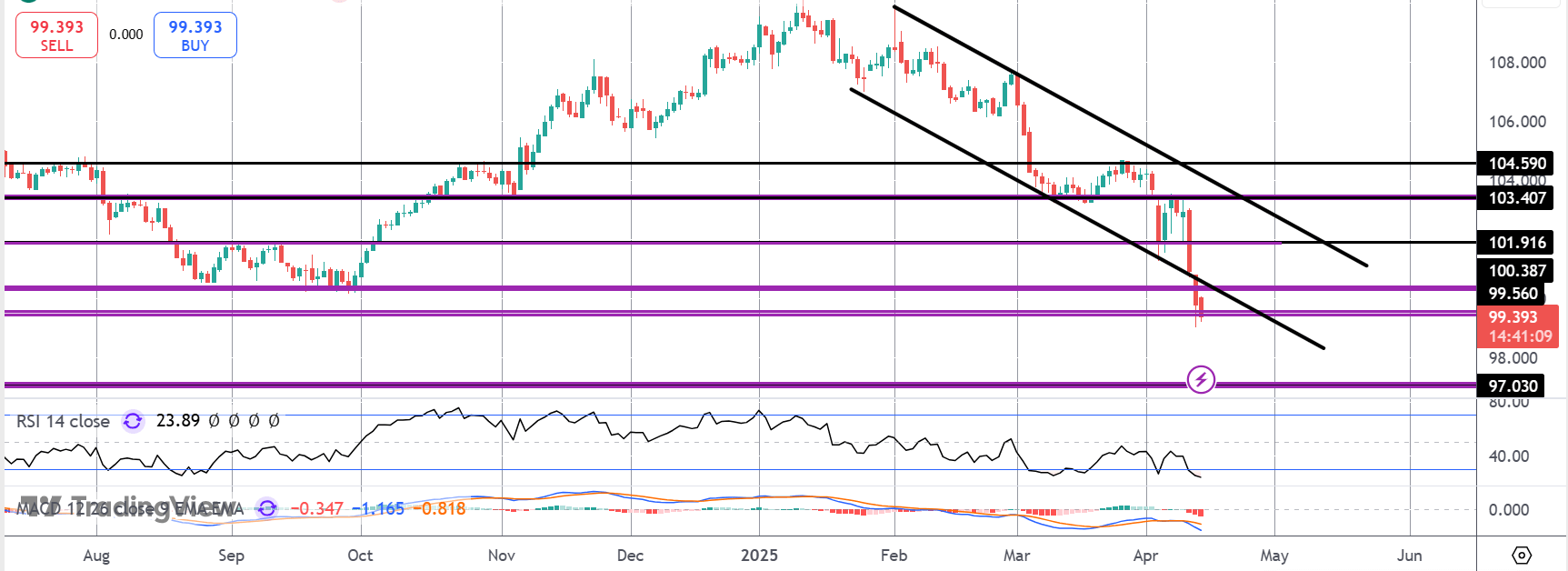

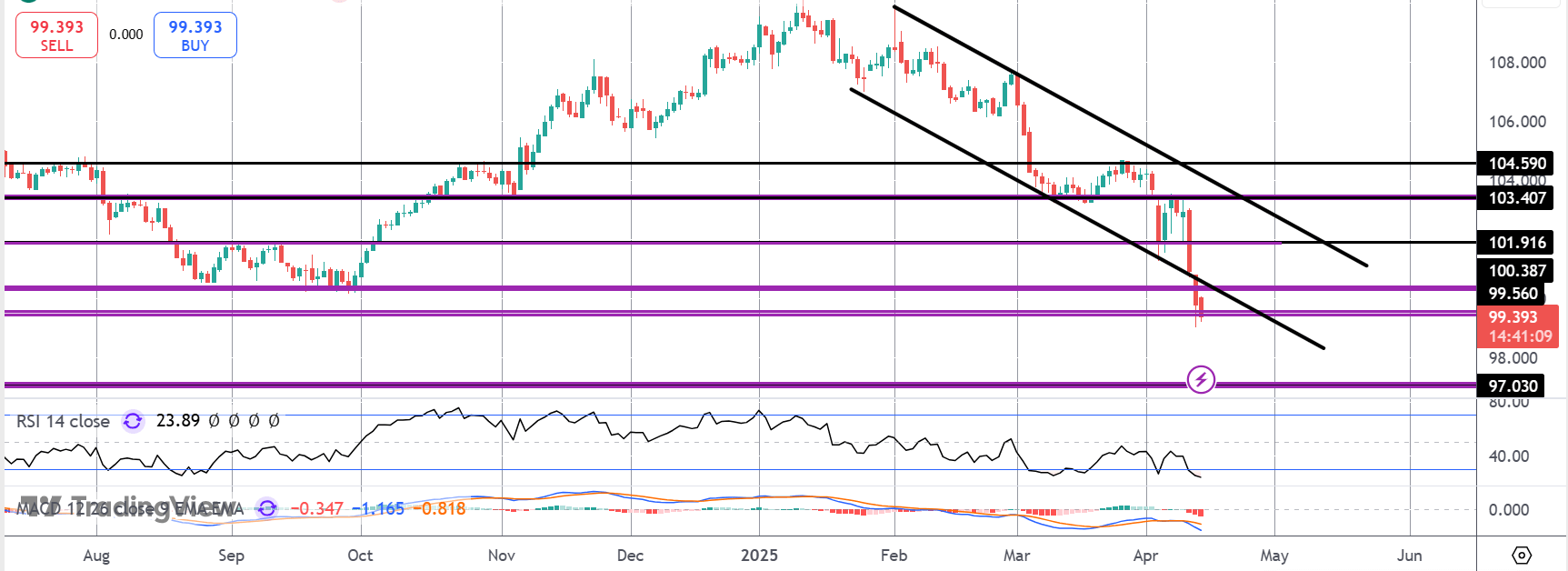

DXY

For now, DXY is sitting on support at the 99.56 level, having broken below the bull channel. With momentum studies bearish, risks are pointed towards a fresh break lower with 97.03 the deeper bear target to watch. Topside, bulls need to get back above 101.91 to alleviate this bearish view.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.