明天美联储前股市强劲开局

摩根大通/第一共和国交易后股市上涨

尽管欧洲交易员昨天因五一银行假期而离开办公桌,但这对市场来说基本上是一个积极的开端。 周末有消息称,摩根大通将收购因流动性问题被监管机构强行关闭的 First Republic 银行,交易员似乎受到了鼓舞。 FRC 的倒闭标志着美国历史上第二大银行倒闭,引发了人们对更广泛银行业的健康状况以及此类倒闭进一步发生的前景的担忧。 然而,随着摩根大通介入接手这项业务,允许客户继续取款,一场灾难在短期内得以避免。

展望本周,由于美联储和欧洲央行都将在未来几天做出利率决定,焦点将从区域银行转移到中央银行。 交易员预计美联储明天会进一步加息 0.25%,不过更大的焦点将放在银行的前瞻性指引上。 随着经济衰退风险的增加以及银行业近期的发展,预计美联储将对未来的利率持更为保守的态度。 如果看到,这应该有助于在短期内保持库存支撑。 预计欧洲央行也将加息 0.25%,但根据今日欧元区 CPI 数据闪现情况,该行可能会在其前景中表现出更强硬的基调。

技术观点

达克斯指数

目前前景仍然乐观。 虽然上周首次突破 15642.76 后失去动力,但重新测试该水平后,该水平已成为支撑,该指数现在再次走高。 在牛市通道内,接下来重点测试16278.35水平。

.png)

S&P 500

The index continues to hover around the 4153.50 level following the rally off 3910 lows. With momentum studies climbing, the focus is on a continuation higher and an eventual test of the 4305 level next. To the downside, 3910 remains the next support to note.

.png)

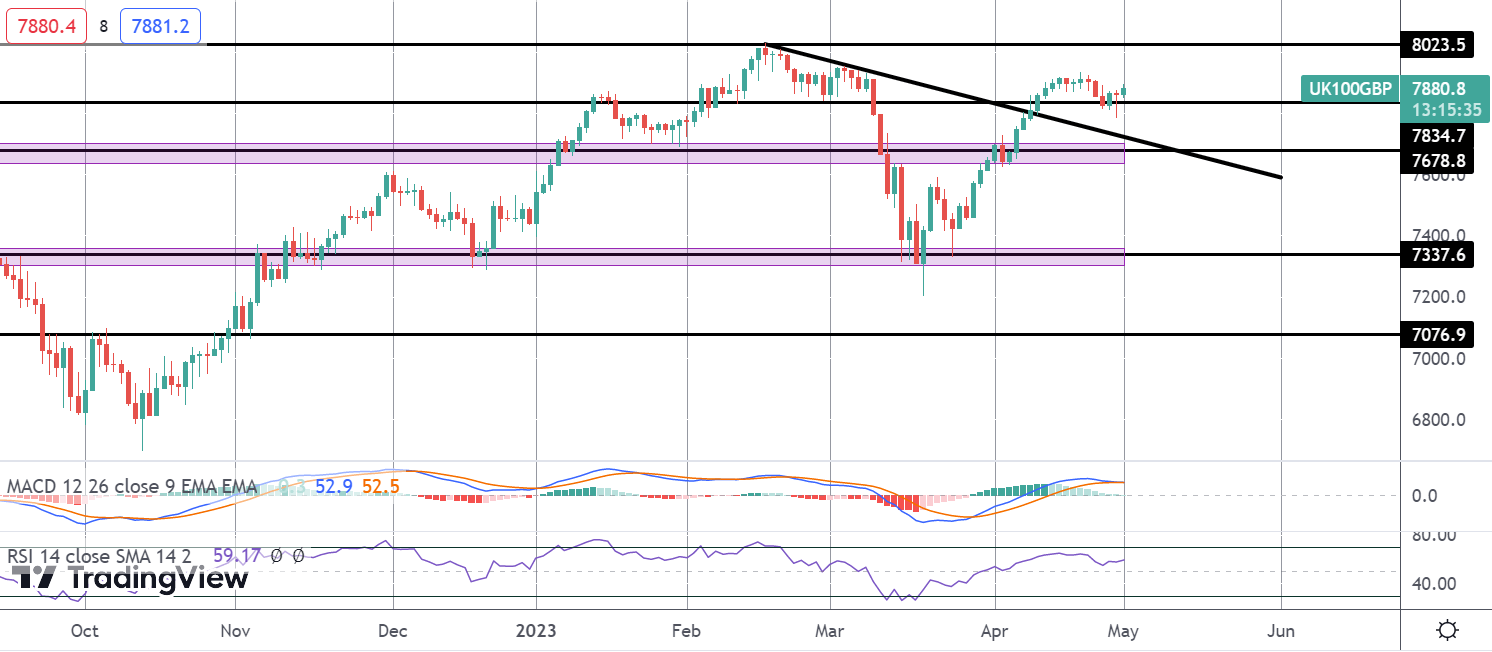

FTSE

Following the stalled breakout above the 7834.7 level, the subsequent retest of the level from above has seen it holding as support for now. With momentum studies still bullish, the outlook remains bullish while price holds above this level keeping the focus on a test of the 8023.5 level next.

Dow Jones

The retest of the 33576.05 level has seen demand kicking in, turning the index higher once again. Price is now approaching a test of the 34523.58 level which is a major resistance area for the index. A break higher here will be firmly bullish, putting focus on 35503.24 thereafter.

.png)

免责声明:提供的材料仅供参考,不应视为投资建议。 本文中表达的观点,信息或观点仅属于作者,而不属于作者的雇主,组织,委员会或其他团体或个人或公司。

过去的业绩不代表未来的结果。

高风险警告:差价合约(CFD)是复杂的工具,由于杠杆作用,存在快速亏损的高风险。 当与Tickmill UK Ltd和Tickmill Europe Ltd进行差价合约交易时,分别有72%和73%的零售投资者账户亏损。 您应该考虑自己是否了解差价合约的工作原理,以及是否有具有承受损失资金的的高风险的能力。

期货和期权:保证金交易期货和期权具有高风险,可能导致损失超过您的初始投资。这些产品并不适合所有投资者。请确保您完全了解这些风险,并采取适当的措施来管理您的风险。