Precious Metals Monday!

In this first installment of Precious Metals Monday, we look at Gold and Silver price movement and the fundamentals that could be driving the changes.

Gold

The yellow metal has seem some stagnation over the last week given the recovery in USD, even ahead of this week’s FOMC meeting. In line with recent commentary, the market is widely expecting a 0.25% rate cut, which has been priced in. However, there has been growing speculation recently for a larger 0.50% rate cut in light of recent dovish comments from certain Fed members. However, last week we saw strong upside movement in USD which came on the back of upside data surprises with both Durable goods and Q2 GDP data better than expected. In light of this strong data, as well as some clarification of comments made by Fed’s Williams, the market pricing for a 0.50% rate cut has fallen back sharply, supporting the USD. Despite recent moves, there is the potential for a great deal of volatility given the remaining risks of a 0.50% cut, as well as the focus, which will be placed on the Fed’s accompanying guidance.

The Fed has been clear about the issues facing the US economy and the need for easing to help offset the downside risks from Trump’s trade war. With this in mind the market is set on a 0.25% rate cut, judging that the Fed will likely want to keep some powder dry for another move later in the year, if needed. Indeed, Fed’s Bullard who is a well-known dove, recently said that he would prefer a 0.25% cut at this meeting.

If the Fed cuts by the expected 0.25%, this could see some downside in gold as USD bears will likely react with disappointment, keeping the greenback well bid. However, if the fed is able to offset such a move with firm guidance as to the likelihood of another cut later in the year, this could keep gold supported. The main outcome which would support gold would be a larger 0.50% rate cut, which at this point would take the market by surprise and could be enough to send gold back up to recent highs.

Technical Perspective

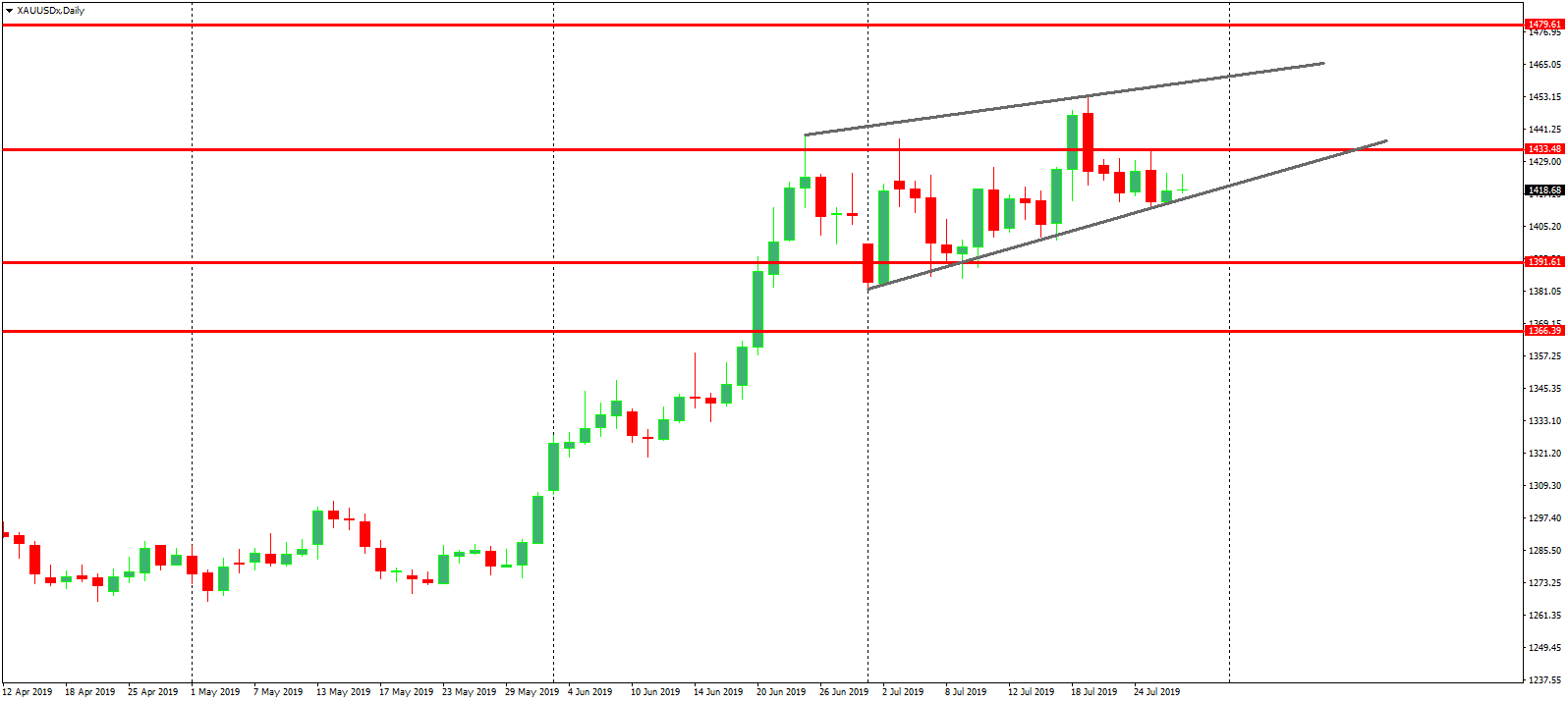

The rally in gold has fizzled out over recent weeks with price breaking back under the 1433.48 highs, though failing to break back below support at the 1391.61 level. The loss in momentum can be seen clearly in the wedging pattern which is playing out at recent highs. Price has been well supported along the lower, rising trend line. If we see a topside break here, the next level to watch will be the 1479.61 region while to the downside, next support is seen down at the 1366.39.

Silver

Silver prices have also seen some giveback over recent sessions. Tracking the moves in gold we’ve seen silver falling back from recent highs, as the resurgent USD takes its toll. Silver has been a strong beneficiary of the recent uptick in Fed easing expectations which, along with being supported by upside moves in gold, has also seen support from higher equities prices. Given its frequent industrial usage, silver is often buoyed by stronger equities prices, particularly the industrials. This week’s trade talks between the US and China will also be closely watched by silver traders keen to see whether the two countries are able to successfully deliver a deal this time around.

Technical Perspective

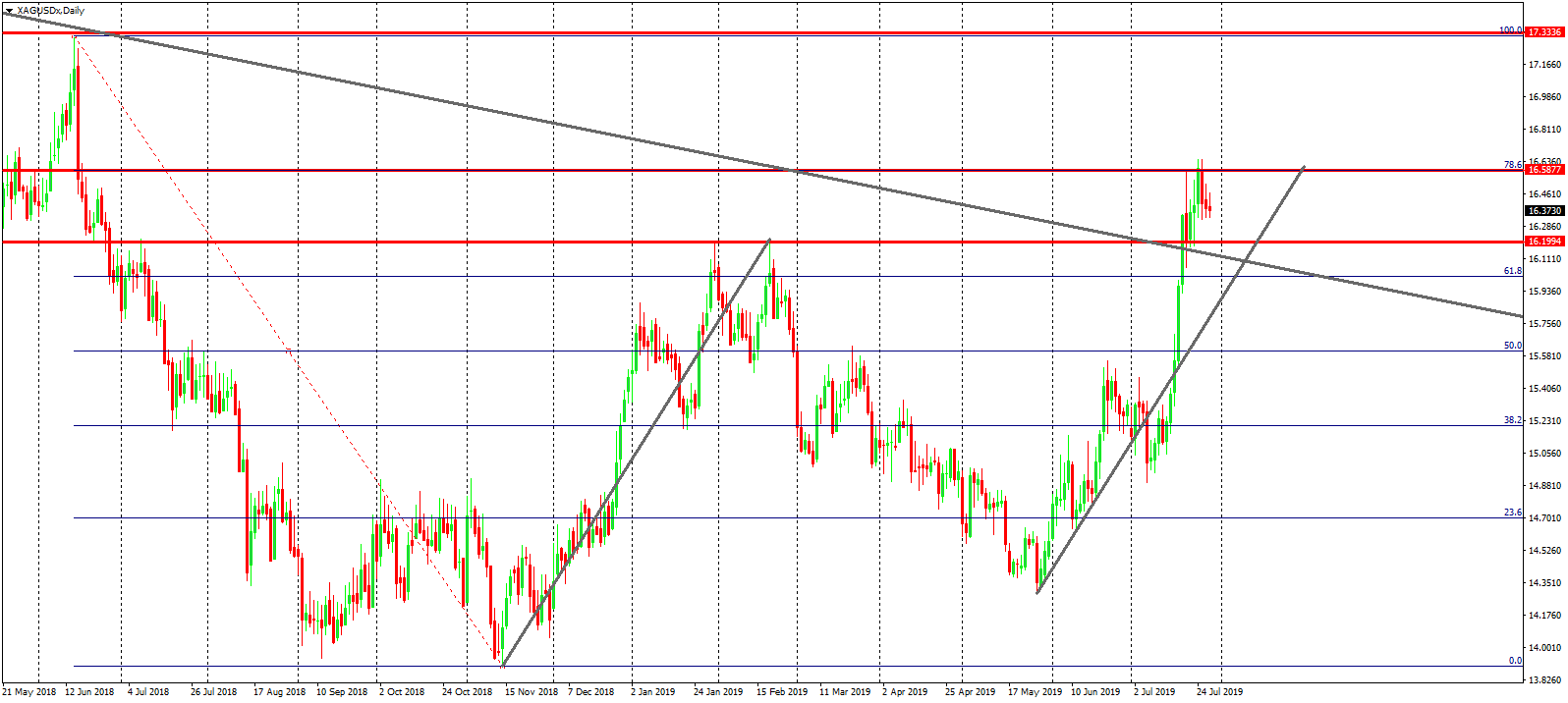

The recent rally in silver has stalled at a test of the 16.5877 level, which is the 78.6% retracement from the April – June 2018 highs. Coincidentally, this also holds the completion of a large ABCD corrective symmetry pattern. There is potential for a deeper move lower from the current levels, though bears will need to see price breaking back below 16.1994, as well as back under the broken bearish trend line to alleviate the near term bearish bias. While price remains above these levels, focus is on a further push higher, with 17.3336 being the next major level to watch.

Please note that this material is provided for informational purposes only and should not be considered as investment advice. Trading in the financial markets is very risky.

Zastrzeżenie: Przedstawiony materiał ma charakter wyłącznie informacyjny i nie powinien być traktowany jako porada inwestycyjna. Poglądy, informacje lub opinie wyrażone w tekście należą wyłącznie do autora, a nie do jego pracodawcy, organizacji, komitetu lub innej grupy, osoby lub firmy.

Wyniki osiągnięte w przeszłości nie są wskaźnikiem przyszłych wyników.

Ostrzeżenie przed ryzykiem: Kontrakty CFD są instrumentami złożonymi i wiążą się z wysokim ryzykiem szybkiej utraty pieniędzy z powodu dźwigni finansowej. 72% and 73% rachunków inwestorów detalicznych traci pieniądze podczas handlu kontraktami CFD odpowiednio z Tickmill UK Ltd i Tickmill Europe Ltd. Powinieneś rozważyć, czy rozumiesz jak działają kontrakty CFD i czy możesz sobie pozwolić na podjęcie wysokiego ryzyka utraty pieniędzy.

Kontrakty futures i opcje: Handel kontraktami futures i opcjami z depozytem zabezpieczającym wiąże się z wysokim stopniem ryzyka i może skutkować stratami przekraczającymi początkową inwestycję. Produkty te nie są odpowiednie dla wszystkich inwestorów. Upewnij się, że w pełni rozumiesz ryzyko i zachowaj odpowiednią ostrożność, aby nim zarządzać.